The property report we’ve been waiting for

Every few months, the team here at Kinsella Estates bring you the round up of property statistics and trends from the previous quarter but this week we have even bigger news. The Central Statistics Office , or CSO, have released a special housing report, based on the latest census figures. This is a big deal as it offers an insight into the market and key measurements that we only get once every five years and for those who have been watching the market over the last five years, you will know that there have been lots of changes – good and bad. This is the first such report since the market started to recover in 2012 and it definitely going to cause a bit of trouble as it contradicts new housing supply numbers released earlier this year by the Department of Housing.

The report covers total housing stock levels, new builds completed and the changing patterns of renting, for example, the trend towards older people renting rather than owning their own home. One Irish Times journalist described it as “a picture of everything we wanted to know about the Irish housing crisis but were too afraid to ask”.

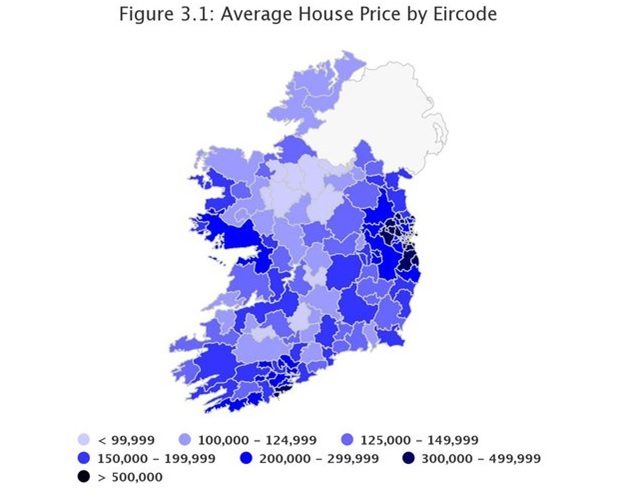

Looking at the 12 months up to March this year, we can see that the overall residential market is up almost 11%. Broken down, this translates into increases in the capital of just over 8% while areas – particularly in the west of the country, which was well behind the recovery we have seen here in the south east – have seen house price growth of up to 20% in the last year. In general, the property market in Ireland is still about 30% below peak levels last seen in 2007.

In terms of volume, the total number of homes purchased over the last year (February 2016 to February 2017) is 37,294. What is interesting to note is the breakdown by buyer type; only a quarter of all buyers were first-time buyers and less than a quarter were investors or non owner-occupiers. This means that homebuyers trading up and down, and those buying holiday homes, represent the driving force within the market. People might be surprised to learn that the average home price in Dublin is now €398,319 and it is difficult to believe that that could have been achieved without the relaxing of the Central Bank lending rules last year and the introduction of the controversial Help-to-Buy scheme. The average price paid for a home nationwide is currently €245,165. In County Wicklow, house prices are the highest outside of Dublin, with an average sale price achieved of €313,023. Take a look at the image above (figure 3.1) for an indication of where real progress has been felt and where the recovery has effectively bypassed.

Outlook

While it is not good news for house-hunters, property prices are set to increase by double digits again this year. In fact, Davy Stockbrokers said that 10% is a conservative estimate of future growth this year and the real figure might be much higher. This will come as a great relief to sellers and homeowners currently caught in the negative equity trap but it raises the ugly question: Is double digit growth sustainable without significant development and can buyers truly depend on new supply coming into the market? Unfortunately, there is no single answer to this but as the new homes specialists in counties Wicklow and Wexford, Kinsella Estates are in a good position to help would-be buyers identify new developments coming up locally over the next 18-24 months.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.