Land of the Week: Tomnafinogue, Tinahely, Co. Wicklow

Full details here.

For your FREE, no obligation, valuation in the South Wicklow and North Wexford area, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at www.KinsellaEstates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours. Alternatively, email me directly on michael@kinsellaestates.ie or telephone: +353 53 94 21718

Ireland’s Residential Property Price Barometer (IPAV)

Earlier this week, the Institute of Professional Auctioneers & Valuers (IPAV) for Ireland published their ‘Residential Property Price Barometer’, which gives a breakdown of prices for two-bed apartments, three-bed semis and four-bed semis across every county in Ireland. According to this most recent research, the cost of an average family home in Dublin is now €527,894 – more than double that of the national average three-bed at €253,466. Wicklow remains the most expensive area outside of Dublin, followed by Kildare and Meath. Counties Longford, Sligo and Leitrim recorded the lowest house prices nationally.

The current average prices for County Wicklow and County Wexford are as follows:

On average, two-bed apartments in County Wicklow are coming in at €202,750, the highest apartment prices outside of Dublin by quite a significant margin. Three-bed semis are achieving an average of €275,591, while four-bed semis are making €344,036.

Similarly, across County Wexford, two-bed apartments are achieving an average sale price of €83,334, with three-bed semis making €145,000 and the four-beds getting, on average, €171,667.

The stand-out surprise is the unexpectedly strong performance of Wicklow apartments. Of course, we know that lack of available stock – in particular, houses – and delays with any new stock coming to the market is still the driving force behind the rising prices. Construction across the country, including the South East region, is nowhere near the level required at this stage. While the industry is set to deliver up to 20,000 homes per year by 2018 (which is up from just 12,666 in 2015), this is not happening quickly enough to meet current or immediate demand within the commute region.

As we watch for the delivery of new homes, it is worth reflecting on changing buyer trends in recent years. For example, here at Kinsella Estates, we can see that house-hunters have never been more organised, better researched or as familiar with the market as this current generation of buyers are. They are knowledgeable and well-informed, however, their expectations of quality and energy efficiency are much higher than their predecessors and developers need to be mindful of this.

With such a dearth of new homes available, particularly here in South Wicklow and North Wexford, it makes sense for home buyers – whether they are looking for their first home, trading up or perhaps downsizing by the coast – to consider purchasing a second-hand home.

Traditionally, September has always been the height of the selling season. Over the past decade, the market has definitely become less seasonal and more opportunistic. The reality is that homes coming to the market locally are being presented to known buyers. Through our offices in Carnew and in Gorey, we know buyers who have been looking for the last few months and when we visit a home to appraise it for sale, very often, we have a good idea of who the buyer is likely to be. This can help speed up the sale process, which is good news for the seller, but more importantly, by knowing the buyer, their budget and their capacity to close the deal, we can add a greater degree of certainty at a time when sellers need it most.

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

House Prices in the South East Continue to Rally

The latest round of Irish residential property price changes has just issued from the Central Statistics Office, or CSO, and the trend from the last few months continues. While average prices nationally are up 11.6% year on year, prices outside of Dublin are growing at a faster rate than they are around the capital. The breakdown is as follows: property prices throughout the rest of Ireland (i.e. not including Dublin) were 11.8% higher in the 12 months to June, with the increase for Dublin 11.1%. This puts annual inflation at 11.6%, which is the fastest pace in two years.

The latest round of Irish residential property price changes has just issued from the Central Statistics Office, or CSO, and the trend from the last few months continues. While average prices nationally are up 11.6% year on year, prices outside of Dublin are growing at a faster rate than they are around the capital. The breakdown is as follows: property prices throughout the rest of Ireland (i.e. not including Dublin) were 11.8% higher in the 12 months to June, with the increase for Dublin 11.1%. This puts annual inflation at 11.6%, which is the fastest pace in two years.

When we look further into those average figures, it appears that the South East region (including Wicklow and Wexford) showed the greatest house price growth with an increase of 16.7% – almost double that of the Mid West and significantly above Dublin rises.

In terms of recovery, prices in the South East region have increased in excess of 50% since the recovery began in 2012/2013; however, they remain approximately 35% below peak/2007 prices. RTE and Irish Times commentary on current Irish house price inflation attributes the pick-up to “the robust economic recovery”, increased mortgage lending, relaxation of the Central Bank deposit rules for home buyers and the Help-to-Buy (HTB) scheme – which, incidentally is under review and in threat of being axed.

If all this talk about rising house prices locally has made you think about selling, you might be interested in the following article: How to Know When it’s the Right Time to Sell

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

How to know when it’s the right time to sell?

Selling your home, holiday home, investment property or perhaps an inherited house or land can be daunting. With so many questions and so much – often conflicting – information out there (online or chats over the garden fence), it can be difficult to get straight answers. When you are thinking of selling, straight answers are exactly what you need. Property valuations that are too vague, or too general, or that carry lots of exceptions and exclusion clauses are just not helpful. What you need is local insight that tells you not only the likely open market value of the property today, but more importantly, you need insights into local supply and demand. This is the difference between listing your property and actually selling your property – we’re guessing that once you have made the decision to sell, you want to get things moving!

Unlike when dealing with an investment or inherited property, the biggest factor in the decision to sell your home should not be market conditions. Certainly, it is important to be aware of current market performance and undoubtedly, there are times when the market trends favour the buyer moreso than the seller, and vice versa, but none of this is more important than your personal, family and financial position.

As your estate agents, our first step generally is to arrange to do a walk-though of your property. This helps us to get specific in terms of the market valuation, but it does so much more than that. It is at this point where we use our experience and expertise to help you, as a seller, prepare your home or investment property for the market and a few weeks of viewings. Long gone are the days when sellers can list a property ‘as is’ just to test the market. The rise in property technology, the increased pace of life and competition in the marketplace all mean that sellers usually only have one opportunity to impress potential buyers in person. In fact, getting them inside the property requires great photos/videos/3D tours and great copy (which is why you need a great estate agent!). For this reason, it is recommended that any little fixes around the house are done prior to getting the photographs taken for the brochure and online listing, and certainly before opening up the property for viewings.

Sellers must not underestimate the importance of preparing the property and this is equally true for the photography and video (or virtual reality tours) as it is for viewings. A bright, airy and freshly painted entrance sets a positive tone for the rest of the home. Stylish furnishings that are consistent with the age/type of property are great but a deep cleaning and decluttering session will go a long way towards impressing house-hunters – as will sparkling windows and neutral tones throughout.

For many people, buying and selling their home coincides with other big life events, like changing careers, getting married, starting/growing a family or perhaps downsizing as our children grow up and leave home. This undoubtedly adds to the pressure, confusion and perhaps feelings of overwhelm. As this is such a big decision, we understand the importance of getting it right. Taking the time to discuss your overall plans will help your estate agent to guide you in the right direction. It is never recommended to make quick decisions in reaction to sudden life changes, but sometimes it has to happen like that. Having a good relationship with your agent will make the transition smoother.

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices located in Carnew and Gorey and chat to any of our team or contact us online. We are happy to facilitate overseas buyers and sellers via Skype or similar outside of regular office hours.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Property Help for Returning Emigrants

The Irish Times ran a series of articles recently about returning emigrants trying to buy property in Ireland. It was targeting those recently returned and those who are planning to return over the next few years.

The Irish Times ran a series of articles recently about returning emigrants trying to buy property in Ireland. It was targeting those recently returned and those who are planning to return over the next few years.

We know from local experience here in counties Wicklow and Wexford that the most recent wave or generation of emigrants (circa. 2008 to 2013) are already starting to return to Irish shores, having amassed experience and savings during their time abroad. For the overwhelming majority of people, returning to Ireland is inevitable. Speaking with people is this position, they usually want to return home around the time they are ready to start a family, or if they already have children, they tend to plan their return around important milestones like starting school or secondary school.

Certainly, they are returning to a healthier economy and jobs market, but there can be no doubt that the everyday property market is much more difficult for buyers and renters now than when they left.

While some return to the market as cash buyers (including first-time buyers), most need to get some portion of finance. If you think it is difficult to deal with the appointments, application forms, receipts and scattered paperwork of applying for a mortgage, just imagine the difficulties trying to do this from outside of Ireland! While banking has moved online, property is still relatively old-school and initial sit-down meetings with a financial advisor or in-branch mortgage manager is still the start of the mortgage application process. That is not to say arranging a mortgage, or approval in principle (AIP) from abroad is impossible, however, the reality is that it is more complicated.

Mortgage applicants in this position are not treated like ordinary, local homebuyers, nor are they treated like residential investors (which is only appropriate); essentially they are the modern hybrid buyer. They are unlikely to secure 90% mortgages, on the other hand, most do not need 90% LTV.

Remote buyers can expect to access approximately 50% but rarely in excess of 70% LTV. One unfortunate aspect here is that property prices are increasing at a faster rate than would-be buyers can grow their savings.

Also, it must be pointed out that overseas residents are not eligible for the help-to-buy scheme for first-time buyers purchasing a newly built home (although news reports this week suggest that this scheme might be axed shortly as it drove up property prices rather than stimulated new supply – on this not, if you are based in the South East and eligible for the scheme please do contact us here at Kinsella Estates to get a list of our new homes, just 45 minutes from South Dublin).

One area of confusion is the new EU directive that restricts foreign lending. This has made it more difficult for mortgage applicants outside the euro zone or not earning income in euro, notable exceptions are made for expats in the UK, Australia and Canada. Ulster Bank, AIB and Bank of Ireland are the main banks lending to returning expats, with Permanent TSB opting for euro zone customers only.

Overseas buyers who are able to access funding should expect to pay interest rates as high as 4.95%, which is considerably higher than the 2.9% rate enjoyed by most first-time buyers already living here.

For many, it might seem foolish to go through the effort of trying to find the right property and then to organise a mortgage while overseas; however, returning home usually means starting a new job, which effectively resets the mortgage counter and you might find yourself waiting a further 12 months before your applicant will be considered. 12 months is a long time in the overheated rental market right now.

Over the past few years, the team here at Kinsella Estates have been working with returning buyers; putting them in touch with mortgage brokers and lenders, helping them to understand the changed market locally and walking them through the purchase process. We understand the challenges and always work to accommodate such buyers through virtual house viewings, out-of-hours Skype calls or whatever is needed. If you are in this position, please do talk to us.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

The long term benefits of buying the show house

The question of whether or not buying the show house is a good idea is an on-going debate and certainly, there are pros and cons but experienced buyers know that the long term advantages tend to out-weigh any of the short term disadvantages.

So, what are the disadvantages of buying a showhouse?

You might need to wait for a few months before closing and moving into the property. In other markets, particularly in the US, a buyer might close the purchase and then agree to lease the property back to developer for the sales period, which could be up to two years. This does not happen in the Irish market, in fact, most developments would only use their show house for a few months or a year for phase one. It is common for developers to sell one show house and simply kit out another so two show houses in the space of a year or two years is not unusual and can work well for both the developers and the buyers.

Another perceived disadvantage is that the site adjacent to the showhouse is often used for car parking so it can be busy/noisy at times. Again, this is a very temporary inconvenience.

As anyone who has ever bought a home in the early stages of a new development launch will know, the show house is highly sought after and generally commands a higher price.

What are the advantages of buying a showhouse?

There are multiple reasons for this but the main one is that the show house is generally finished to an excellent quality, beautifully styled and furnished with top end, luxury brands that the developer writes off as a promotion and marketing expense so the full (trade) cost is not passed on to the new buyer.

Also, at a more basic level, all new developments up -sell ‘extras’ that a buyer can pay for if they want a higher specification throughout. This is always demonstrated throughout the showhouse so you can expect that it comes equipped with the highest specification available.

There is nothing standard about a showhouse.

The kitchen, including worktops and light fittings are invariably top quality. This is also true of flooring, however, do remember that what is visually beautiful might not always be practical for families (cream carpeting comes to mind!).

In addition to the high-end finish, showhouses are a feast for interior design enthusiasts with opulent furnishings that a buyer might never be able to buy at the early stages of buying a home. In most cases, the house is sold with everything included, right down to the bed linen, duvet covers and soft furnishings like cushions and table lamps.

Mirrors are a surprising expense for new homeowners and most showhouses use them throughout the house to enhance the light and space available.

Outside the house, the garden is usually architecturally landscaped in a low-maintenance finish (very important for busy families).

In the short-term, showhouses tend not to give new owners the same teething problems as standard new homes as settling cracks are dealt with as they arise – the sales agent will always ensure the showhouse is kept in top condition throughout its use. The same principle applies to snaglist issues. These are generally dealt with as soon as they are identified.

For many buyers, the convenience is irresistible. You can walk into your new home with a only suitcase and there’s no waiting around.

In the long term, as the glossy interior of any home fades over a few years, the showhouse quality will generally stand the test of time.

We are currently listing a former showhouse and the high-quality fit-out is still evident throughout.

1 Woodlands Drive, Gorey, County Wexford is a superb four bedroom detached home and garden, in excellent condition throughout (asking price €235,000).

Checklist for property sellers

Checklist for Property Sellers

Selling your home (or investment property) can seem overwhelming when you first start thinking about it. As second-generation estate agents, we genuinely understand that a lot of work goes into researching and actually making the decision to sell before you even consider embarking on the sales process. So, with that in mind, we wanted to make life a bit easier for prospective sellers by preparing a handy checklist – be sure to add your own and to let us know anything else that ought to be included on this list:

- Is selling the right decision for you?

So often, this very important first step gets overlooked as being obvious but for many people, it is not obvious at all. Irish people tend to move home less often than our UK neighbours (not counting the dreaded student and early career rentals!) so, in our experience, it is something that families think about for a year or perhaps even two years before they actually bring their homes to the market. And we understand that. It is a huge decision for people to make for their families, whether their children are young or whether they have left the family home for college or to start their careers elsewhere, the family home is still considered the family home. The decision is about more than finances and convenience or even suitability, there is an emotional component that makes it difficult to reach a decision. At Kinsella Estates, we get to know our sellers and try our best to understand the emotional elements as well as the practical aspects like whether this is a good time to sell the type and value of property that you own. We see our job at this stage as providing the right market and financial information so that you, the seller, can make the right personal decision.

- Check local property prices via the property price register

Once you have made the decision to sell, it is important to get a sense of local values. Local properties listings are helpful, as it the national property price register – which is publically accessible. Please bear in mind that this register can be a few months behind as the conveyancing process usually takes a few months from going sale-agreed to actually closing the contracts and handing over keys so get up-to-date market information from your local agent.

- Get valuation and local insights – supply vs. demand

The next step is to get a valuation on your property, at Kinsella Estates, this is a complimentary service we offer to property owners. This valuation is important, but of more importance, is to find out about local supply and demand levels. This just one of the ways that local estate agents bring their expertise to the sales process. Market valuation is one thing, but you need to know what other properties on the market your home will be competing with. Also, you need to know what level of demand exists – roughly how many buyers are currently looking for a property, similar to yours, and have the right budget to purchase? This level of detail will greatly help a seller by setting very realistic expectations of the market and how well the property is likely to sell.

- Get your legal documentation in order and instruct your solicitor

Once you are happy with the valuation and ready to kick off the sales process, we always recommend instructing your family solicitor. Once instructed, your solicitor will ‘take up’ the title deeds and supporting documentation from your bank. Or, if there is no mortgage on the property, your solicitor will draft the contracts for sale so that they are ready to issue as soon as the property is sale-agreed. By taking this step early, it eliminates potential delays and gives your solicitor an opportunity to request further documentation from you , for example, receipts of property tax or NPPR tax.

- BER

Most homes that have now been bought or sold in the last decade are unlikely to have a Building Energy Rating or BER certificate. This is a mandatory certificate that every property being sold or leased must have and provide to the buyer or tenant. At Kinsella Estates, we can organise that for you quickly and at an inspection time that suits you.

- Preparing the property exterior

The next step is to prepare for the marketing photographs and content for your brochures and online listings. In this increasingly busy – and digital – age, it is crucial to have great photos (which we appreciate can be difficult in Irish weather, but luckily we work in the sunny south east so we have an advantage!). If it is possible to spruce up the exterior and give it a paint job then we definitely recommend that, if not, clear away as much as possible and give the front door a fresh coat of paint and perhaps a seasonal planter outside.

- Preparing the interior for photos

We talk about preparing for viewings with buyers in another post but for today, it’s all about preparing for photographs. The golden rule is to maximise light and space and to minimise ‘stuff’ or clutter. Prospective buyers need to see your home presented in the best possible way and they want to see as many photographs as possible. Remember, you are unlikely to sell your home to someone who doesn’t view it (with the exception of remote buyers via 3D tours, which we now offer) so the job of the brochure and online listing is to showcase your home to its best so that house-hunters will want to visit.

Kinsella Estates are on-hand to offer helpful and practical advice at every stage of the selling process. We understand the importance of bringing your home to the market in a way it deserves, and we know how to attract attention from the right buyers to maximise the value and potential of your property. Talk to us about your individual property and let us help you create the best first impression for your home.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

The property report we’ve been waiting for

Every few months, the team here at Kinsella Estates bring you the round up of property statistics and trends from the previous quarter but this week we have even bigger news. The Central Statistics Office , or CSO, have released a special housing report, based on the latest census figures. This is a big deal as it offers an insight into the market and key measurements that we only get once every five years and for those who have been watching the market over the last five years, you will know that there have been lots of changes – good and bad. This is the first such report since the market started to recover in 2012 and it definitely going to cause a bit of trouble as it contradicts new housing supply numbers released earlier this year by the Department of Housing.

The report covers total housing stock levels, new builds completed and the changing patterns of renting, for example, the trend towards older people renting rather than owning their own home. One Irish Times journalist described it as “a picture of everything we wanted to know about the Irish housing crisis but were too afraid to ask”.

Looking at the 12 months up to March this year, we can see that the overall residential market is up almost 11%. Broken down, this translates into increases in the capital of just over 8% while areas – particularly in the west of the country, which was well behind the recovery we have seen here in the south east – have seen house price growth of up to 20% in the last year. In general, the property market in Ireland is still about 30% below peak levels last seen in 2007.

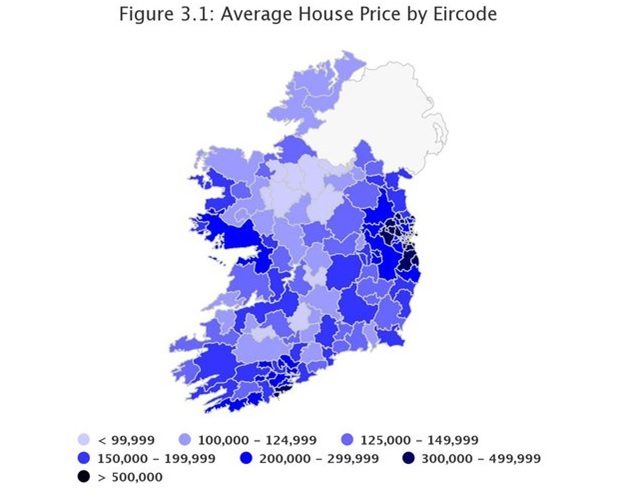

In terms of volume, the total number of homes purchased over the last year (February 2016 to February 2017) is 37,294. What is interesting to note is the breakdown by buyer type; only a quarter of all buyers were first-time buyers and less than a quarter were investors or non owner-occupiers. This means that homebuyers trading up and down, and those buying holiday homes, represent the driving force within the market. People might be surprised to learn that the average home price in Dublin is now €398,319 and it is difficult to believe that that could have been achieved without the relaxing of the Central Bank lending rules last year and the introduction of the controversial Help-to-Buy scheme. The average price paid for a home nationwide is currently €245,165. In County Wicklow, house prices are the highest outside of Dublin, with an average sale price achieved of €313,023. Take a look at the image above (figure 3.1) for an indication of where real progress has been felt and where the recovery has effectively bypassed.

Outlook

While it is not good news for house-hunters, property prices are set to increase by double digits again this year. In fact, Davy Stockbrokers said that 10% is a conservative estimate of future growth this year and the real figure might be much higher. This will come as a great relief to sellers and homeowners currently caught in the negative equity trap but it raises the ugly question: Is double digit growth sustainable without significant development and can buyers truly depend on new supply coming into the market? Unfortunately, there is no single answer to this but as the new homes specialists in counties Wicklow and Wexford, Kinsella Estates are in a good position to help would-be buyers identify new developments coming up locally over the next 18-24 months.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

40 Acre Farm Lands at Knockananna, Arklow, County Wicklow

C. 40.5 Acre (16.4 Hectare) Non Residential Roadside Farm

At Shielstown, Knockananna, Arklow, Co.Wicklow.

The farm is laid out in 1 block of permanent pasture with the exception to C. 4 Acres which is in need of reclamation. The lands are well fenced and offer an opportunity to accommodate a variety of agricultural uses and are divided into equal sized divisions.

The lands have the benefit or two water supplies, one being a fresh water supply via a never failing stream. The farm also has extensive road frontage 300m approximately to the local road.

Buildings:

– Modern shed built to grant specification

64 x 60 ft (18m x 19.5m)

– Also a concrete holding area

44 x 42 ft (12.8m x 13.5m)

Location: The lands are located only 4.6km’s from Knockananna, 13km’s Aughrim & 13.5km’s from Tinahely

Entitlements: Single farm payment for 2017 will be 2,188.00

Services: Water – well

Directions:

From Knockananna take the Ballygoben road(leaving the 1798 monument on right), continue for 2.5km, take the sharp left and continue for 2km and the farm is on the left hand side.

Maps and further details available here: http://kinsellaestates.ie/property/shielstown-knockananna-arklow-co-wic/

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Local farmers with ‘spending power’ drive big prices for land in Wexford

Original article by Jim O’Brien, on Independent.ie

The last few weeks of 2016 saw somewhat of a flurry of sales in the auction rooms with good prices achieved, writes Jim O’Brien.

In the southeast, Alan Kinsella of Kinsella Estates Gorey and Carnew sold a 48ac non-residential farm at Ballybuckley, Bree near Enniscorthy in Co Wexford for €662,000 or €13,600/ac.

Located 800m from the village of Bree, the land is about 5km from Enniscorthy and across the road from the well-known Wilton House.

Currently in stubble, the holding is made up of two distinct lots consisting of a 16.15ac parcel with about 300m of road frontage and a 32.33ac parcel with laneway access.

The stubble ground is described by Mr Kinsella as good quality, south-facing land with access from two roads.

At auction, two rounds of bidding saw the amount on offer for the two lots reach a total of €465,000.

The 16.15ac piece opened at €160,000 and with two bidders in the chase, it was making €220,000. The 32.3ac parcel opened at €200,000 and with two bidders in action, it held at €245,000.

Bidding then concentrated on the entire in a sale driven by the two customers who had bid on lot two in the first round. When the amount on offer reached €580,000, Mr Kinsella consulted with the vendor and the property was put on the market at that price.

However, this was far from the end of the story and a further series of bids from three active customers saw the price break the €600,000 mark.

But still the hands kept rising until the hammer fell at €662,000 and a local farmer bought the place for €13,600/ac.

Enniscorthy auction

Staying in Wexford, Frank McGuinness and Michael O’Leary of Sherry FitzGerald O’Leary Kinsella sold a 92ac farm at Fairfield, The Still, Enniscorthy for €1.24m or €13,500/ac.

The holding, which includes a derelict house, has been idle for more than 10 years and will take some works to clear overgrowth and vegetation and bring it back to full farming production.

Auctioneer Frank McGuinness said that although the land is overgrown, it is fundamentally very good productive ground. The place has plenty of road frontage divided as it is by the Enniscorthy to Caim road.

Prior to auction, the property was guided at between €750,000 to €900,000 but on the day it exceeded all expectations.

Frank McGuinness was in charge of the gavel and opened proceedings with a 19ac lot across the road from the main farm. This opened at €150,000 and, with two customers in contention, was bid to €280,000.

The main lot – consisting of 73ac with the derelict house – attracted three interested parties and was bid to a hefty €820,000.

This gave a combined €1.1m for the entire, well ahead of the guide.

Mr McGuinness put the entire to the floor at €1.1m and with two bidders in action it quickly rose to €1.2m.

At this point, a new bidder entered the fray.

With four customers in action, the price rose quickly to €1.24m at which point the hammer fell and the place was bought by a solicitor based in Enniscorthy – believed to be acting for two clients.

Mr McGuinness said that while he was surprised at the price paid, the extension of the M11 to by-pass Enniscorthy and improvements to the New Ross road resulted in a lot of CPO land purchase in the area, hence farmers in the area have spending power.

Alan Kinsella agreed.

“The farmers who sold land for these developments have to spend it on land to avoid paying tax on it so there is more money for land in this vicinity at the moment,” he said.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.