Rebuilding Ireland Home Loan Scheme

As part of our ‘Incentives and Schemes for Homeowners’ we will be sharing some information on what is available from the Government over the coming weeks. Starting with the Rebuilding Ireland Home Loan Scheme, here are some bits of information every prospective buyer should know.

What is it?

A Rebuilding Ireland Home Loan is a fairly new Government backed mortgage for first time buyers. It has been available, nationwide from all local authorities since the 1st February 2018 and in this time it has been met with a good response.. First time buyers are invited to apply for the Rebuilding Ireland Home Loan to purchase either a new or second hand property as well as having the choice to build their own home. The home loan is a normal capital and interest bearing mortgage which is, as expected repaid via direct debit on a monthly basis. It has replaced the Home Choice Loan and local authority mortgages that were traditionally used prior to this new scheme. It will not be suitable for everyone as it has some terms and conditions but it is something worth looking into if you have been declined a mortgage by (at least) two banks or building societies.

What’s the T&C’s?

Like anything, there are lots of terms and conditions as well as a lot of paperwork but it is worth it to investigate if you are eligible for the scheme. As advised on the Rebuilding Ireland website, prospective buyers can borrow up to 90% of the market value of the property they choose. Borrowers can also avail of reduced interest rates, higher loan amounts (i.e. greater than the standard 3.5 times yearly salary). One main factor is that the maximum market value of each property is capped at €320,000 in counties, Cork, Dublin, Galway, Kildare, Louth, Meath and Wicklow; with the rest of the country capped at €250,000. This limits the amount that can be borrowed to no more than €288,000 in the counties Cork, Dublin, Galway, Kildare, Louth, Meath and Wicklow and no more than €225,000 in the rest of the country. For more information there is a home loan calculator here.

A Rebuilding Ireland Home Loan offers three rate products:

- 2% fixed for up to 25 years (APR 2.02%)*

- 2.25% fixed for up to 30 years (APR 2.27%)*

- 2.30% variable (subject to fluctuation) for up to 30 years (APR 2.32%)*

* Rates are subject to change. Mortgage rates are set on the date of drawdown of the loan.

It is advised that prospective buyers consider their options when choosing the rates and seek professional and independent advice to decide on the best route for them.

To be eligible for a Rebuilding Ireland Home Loan you must be:

- A first time buyer

- Aged between 18 and 70 years old

- In continuous employment for a minimum of two years, as the primary earner or be in continuous employment for a minimum of one year, as a secondary earner

- Earning an annual gross income of not more than €50,000 as a single applicant or not more than €75,000 combined as joint applicants

- Able to submit two years certified accounts if you’re self-employed

- Able to provide evidence of insufficient offers of finance from two banks or building societies

- Not be a current or previous owner of residential property in or outside the Republic of Ireland

- Occupying the property as your normal place of residence

- Purchasing or self-building a property situated in the Republic of Ireland of no more than 175 sq. m. (gross internal floor area)

- Purchasing or self-building a property which does not exceed the maximum market value applicable for the county in which it is located

- Able to consent to an Irish Credit Bureau check as requested

To find out if you are suitable for the Rebuilding Home Loan find out more here.

For your FREE, no obligation, valuation in the South Wicklow and North Wexford area, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at www.KinsellaEstates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours. Alternatively, email me directly on michael@kinsellaestates.ie or telephone: +353 53 94 21718

How to know when it’s the right time to sell?

Selling your home, holiday home, investment property or perhaps an inherited house or land can be daunting. With so many questions and so much – often conflicting – information out there (online or chats over the garden fence), it can be difficult to get straight answers. When you are thinking of selling, straight answers are exactly what you need. Property valuations that are too vague, or too general, or that carry lots of exceptions and exclusion clauses are just not helpful. What you need is local insight that tells you not only the likely open market value of the property today, but more importantly, you need insights into local supply and demand. This is the difference between listing your property and actually selling your property – we’re guessing that once you have made the decision to sell, you want to get things moving!

Unlike when dealing with an investment or inherited property, the biggest factor in the decision to sell your home should not be market conditions. Certainly, it is important to be aware of current market performance and undoubtedly, there are times when the market trends favour the buyer moreso than the seller, and vice versa, but none of this is more important than your personal, family and financial position.

As your estate agents, our first step generally is to arrange to do a walk-though of your property. This helps us to get specific in terms of the market valuation, but it does so much more than that. It is at this point where we use our experience and expertise to help you, as a seller, prepare your home or investment property for the market and a few weeks of viewings. Long gone are the days when sellers can list a property ‘as is’ just to test the market. The rise in property technology, the increased pace of life and competition in the marketplace all mean that sellers usually only have one opportunity to impress potential buyers in person. In fact, getting them inside the property requires great photos/videos/3D tours and great copy (which is why you need a great estate agent!). For this reason, it is recommended that any little fixes around the house are done prior to getting the photographs taken for the brochure and online listing, and certainly before opening up the property for viewings.

Sellers must not underestimate the importance of preparing the property and this is equally true for the photography and video (or virtual reality tours) as it is for viewings. A bright, airy and freshly painted entrance sets a positive tone for the rest of the home. Stylish furnishings that are consistent with the age/type of property are great but a deep cleaning and decluttering session will go a long way towards impressing house-hunters – as will sparkling windows and neutral tones throughout.

For many people, buying and selling their home coincides with other big life events, like changing careers, getting married, starting/growing a family or perhaps downsizing as our children grow up and leave home. This undoubtedly adds to the pressure, confusion and perhaps feelings of overwhelm. As this is such a big decision, we understand the importance of getting it right. Taking the time to discuss your overall plans will help your estate agent to guide you in the right direction. It is never recommended to make quick decisions in reaction to sudden life changes, but sometimes it has to happen like that. Having a good relationship with your agent will make the transition smoother.

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices located in Carnew and Gorey and chat to any of our team or contact us online. We are happy to facilitate overseas buyers and sellers via Skype or similar outside of regular office hours.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Wexford builder is the new chairman of IHBA

Congratulations to Wexford builder, Anthony Neville, of Anthony Neville Homes, on his recent appointment as Chairman of the Irish Home Builders Association (IHBA) for 2017 and 2018.

It is great to see a provincial builder at the helm, particularly at such an important time for residential building. He has pledged to address the main issues hindering new development outside of Dublin, namely, the high cost of building, and he is optimistic about development prospects here in the South East. Shortly after his appointment, he had the following to say:

“We have seen in some areas of provincial Ireland that house building has recommenced again. This is only in areas where the sales price of houses has exceeded the construction costs, therefore creating a margin that makes it viable for the homebuilders to secure finance from their financial institutions and build much required homes. We, at Anthony Neville Homes, have been lucky over the last number of years to have had exposure to the greater Dublin area on our sites in Maynooth, Kinsealy and Saggart, where we have seen continuous demand for our product. However, over the last 12 months we have noticed the increase in demand spreading down through Wicklow to our site at Baltinglass and hopefully we will be recommencing construction at one of our Enniscorthy sites in Co. Wexford. Members of the IHBA have experienced increased demand in places such as Gorey, Kilkenny, Portlaoise and Tullamore, so whilst the recovery is taking a lot longer than we had hoped, it is spreading gradually further away from Dublin.”

Help-to-Buy under threat

Anthony is also a strong supporter of the help-to-buy(HTB) scheme and has spoken out about the need to retain the initiative after news last week that the aid scheme for first-time buyers might be shut down. This is certainly positive for first-time buyers who are eligible for the scheme but perhaps not for those who have worked outside of Ireland for the last few years and are finding themselves at a disadvantage when it comes to bidding on property back in Ireland. The application of the tax relief means that eligible first-time buyers can outbid non-eligible buyers (of equal financial status) for the same property but it only applies to new homes.

In fact, buyers who are not entitled to avail of the HTB relief are much better off looking at contemporary or recently built second-hand homes. This offers a good opportunity for sellers and those thinking of selling in 2017. If you are considering selling and want to know a bit more about your market and about demand for your particular property locally, just contact us for a quick and confidential chat.

The M11 motorway has made towns like Arklow and Gorey much more attractive to buyers. Here at Kinsella Estates, we are currently listing a great three-bed semi-detached house in Arklow, just five minutes off the M11 motorway and less than 40 minutes from Dublin.

Link to further details here:

This beautiful property is presented in showhouse condition. Call us now to arrange a viewing on +353 53 9421718. Also, don’t forget that we accommodate house-hunters and buyers from outside of Ireland and can do a virtual walkthrough of this or any of our other listed properties. If you need extra help, just ask!

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Less than half the population are ‘content’ with their housing

It’s that time of the quarter again, lots of property news, results and price reports. Daft.ie and MyHome.ie are showing average property price increases of almost 10% nationwide. While the average increase is lower across County Wicklow, this is likely due to fewer transactions and those transactions are coming from an already-high value base. County Wexford is picking up speed and this has been one of the busiest quarters that we have seen in years. In general, house prices are up 40% since the bottom of the market – which is great news for sellers and home owners whose property might be in negative equity but not so good for house hunters.

Added to the usual run of house price news, KBC Bank have published their Homebuyer Sentiment survey. These type of survey is few and far between as ‘sentiment’ is more difficult to measure than percentages or euro, but the findings are usually more interesting. And this one doesn’t disappoint. Key findings include the following:

- Only 49% of Irish consumers are content with their current housing

- 23% are not in a position to purchase despite wanting to

- 28% are considering buying within the next two years, with half of these actively house hunting

- Of those currently ready to buy, less than a quarter are investors while the remaining buyers are an equal mix of first-time buyers and those trading up or down

The phrase ‘pent-up demand’ has been thrown around since the confusing days of 2011/2012 and the effects of this have been felt in the market for a few years. Usually we think in terms of people who are either looking to buy or to sell; this survey includes homeowners who are trapped in unsuitable and inappropriate housing.

Interestingly, the survey estimates (based upon their random sampling) that there are approximately 70,000 would-be buyers ready to hit the market, with a total anticipated demand of 300,000over the next two years. While we have sufficient zoned land in parts of County Wexford to deal with short-term future development, the same cannot be said for most of County Wicklow.

All of this activity and these findings are reinforcing the trend for home buyers to look further from the Capital as they search for their future home. Improved road infrastructure right through Wicklow from the M50 to Gorey, just over the Wexford border, makes a 45 minute commute possible from smaller towns like Carnew, Shillelagh and Tinahely. For people looking for a coastal home, Riverchapel, just outside the seaside town of Courtown, will be an increasingly attractive location.

To view a selection of the properties currently available, visit kinsellaestates.ie

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange any viewings.

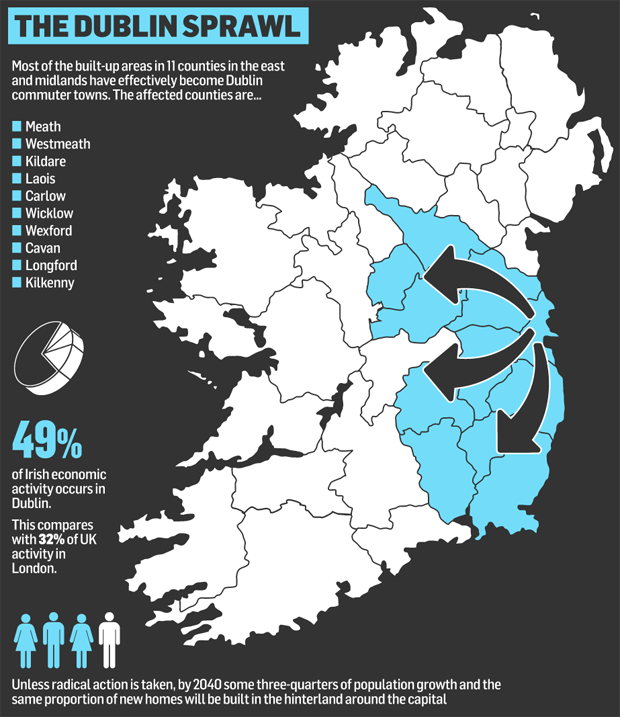

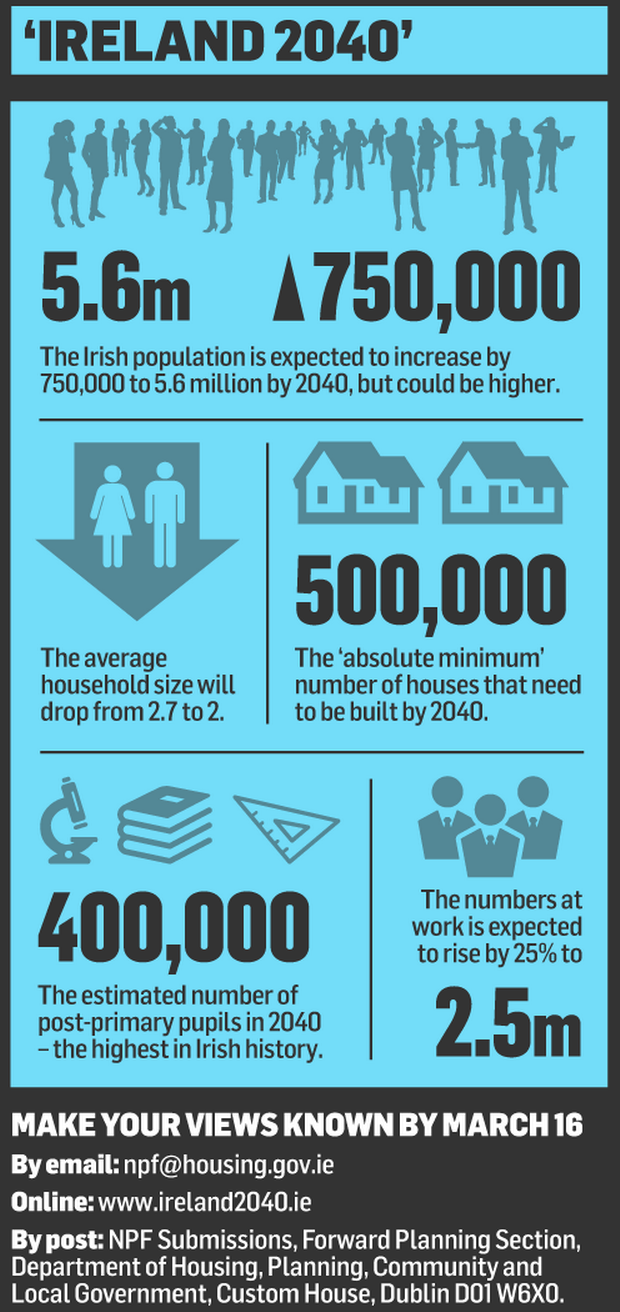

Dublin is ‘Eating’ Ireland: Wicklow & Weford Set to Benefit

According to the Independent newspaper reporting of the recently released ‘Ireland 2040’ document, Dublin is “eating” the rest of the country

The report, launched by an Taoiseach and the Housing Minister last week, makes for tough reading for most of rural Ireland. It charts the gradual decline of rural businesses, communities, towns and villages. The simple reality is that when money leave an area, the people must surely follow. And this is exactly what happened. Today, close to half of all economic activity (49%) is generated in Dublin, which is pulling the labour force away from their home counties and closer to the capital. That figure is particularly worrying when you compare it to our closest neighbours; London generates only 32% of England’s economic activity.

We have been hearing about a two-tier country since the early days of the property crash and here in the South East, we know first-hand that recovery is not happening in a fair, uniform way. But this report forecasts where the population will be by 2040 if these trends continue, and it’s not good news for the majority of the country.

As we can see from the above image, all parts of counties Wicklow and Wexford are likely to benefit from this over the coming years and decades as the commuter-belt widens.

Over the past 20 years, half of the population growth in the entire State has been in and around the Dublin area. Without some big changes, this number is set to jump to 75% of population growth happening in that region by 2040. This is dire news for many but the South East is now looking more and more attractive, and not just for home buyers and investors. Businesses looking for a base outside of the capital, healthcare providers, education centres and other service providers are likely to come in this direction.

The work, development and investment cluster will not necessarily happen in Dublin. In fact, the report suggests that Dublin is or will become ‘the Dublin City Region’, extending into 10 other counties from Cavan to Wexford.

This report will impact hugely on our local planning over the next few years. As more commuters look south of Dublin and Wicklow, into Wexford, we must ensure that we have enough homes, hospital beds, school places and other necessary facilities for our growing population. For investors looking to buy strategically, Wexford offers particular value for money with ever-increasing potential for capital value appreciation.

Finally, there is a new State plan to save our rural towns and villages underway, this plan includes grants and incentives for buyers to restore derelict homes, and we’ll talk more about this next week.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Your Guide to the Help-to-Buy Scheme

Budget 2017 announced the Help-to-Buy scheme, which has proven controversial within the industry, to help intending first-time buyers to put together the deposit required to purchase or self-build their new house or apartment.

The scheme works by way of an income tax and DIRT tax refund, in respect of payments made over the previous four tax years. There are three types of applicants who can apply for the Help-to-Buy scheme, namely: retrospective applicants or buyers whose contracts are signed between 19 July 2016 and 31 December 2016; first-time buyers whose contracts are signed between 1 January 2017 and 31 December 2019; and first-time self-build applicants building between 1 January 2017 and 31 December 2019.

Eligibility:

- The buyer must be a first-time buyer, specifically, the buyer must not have either individually or jointly with any other person (directly or indirectly), previously purchased, or built a property. Where more than one individual is involved in purchasing or building a new home, all of the individuals must be first-time buyers.

- The house or apartment must be a new-build (may be self-built)

- The purchase must be dated between 19 July 2016 and 31 December 2019

- The property must have been purchased or built as the first-time buyer’s home and not acquired for investment purposes.

- The property must be occupied by the first-time buyer, or at least one of the first-time buyers in the case of multiple first-time buyers (a group), for a period of five years.

How to apply:

- Registered for myAccount (PAYE) or ROS (self-assessed)

- PAYE taxpayers will need to complete Forms 12 (available through ROS) for the tax years selected for refund

- Self-assessed taxpayer will need to complete Forms 11 (available through ROS) for each of the four years immediately prior to the claim. Please not that any outstanding taxes must be paid.

In order to apply for the scheme/refund, buyers must enter the following information online:

- Property details including address and price

- Details of each first-time buyer and refund agreed

- Developer/Contractor details or

- Details of the Solicitor if self-building

- Upload a copy of the signed

- Balance of the deposit to be paid

- Contract completion date

- Mortgage details

- For self-builders, proof of drawdown of the first mortgage tranche payment

All details must be verified by the Developer/Contractor in the case of a new build, or by the purchaser’s Solicitor in the case of a self-build, before the refund can be paid out.

For further details on the scheme, contact the Office of the Revenue Commissioners

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Wexford land tops €13,500 per acre at auction

Kinsella Estates had the privillage of bringing 48.48 acres of prime holding at Ballybuckley, Bree, Enniscorthy, Co. Wexford under the hammer last week.

The land is located less than 1km from Bree and 5.1km from Enniscorthy, across from Wilton House, with 0.3km of road frontage. Given the high quality of the land, and its suitability to any farming enterprise, a high level of demand was expected.

The auction, which took place at the Riverside Hotel in Enniscorthy last Friday December 16th, was widely marketed beforehand and it was certainly well attended. The lands were offered in one or two lots in advance of the auction but intensive, competitive bidding on the day ensured that the entire holding went in one lot.

The bidding opened at €350,000 and strong interest in the room meant we received no fewer than 64 bids!

Kinsella Estates auctioneer Michael Kehoe decreed the land to be sold to the highest bid at €662,000,which is over €13,500 per acre. It was a great result for the seller and for the stellar Kinsella Estates team this close to the holidays.

It takes strong local knowledge, market expertise and relationships within the community to sell agricultural lands – this is where Kinsella Estates can help you. We understand the market and know the value of land and property locally, more importantly, our marketing expertise will attract the right buyers in order to achieve the best price for you.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing.

Riverchapel Wood: Final house available in current phase

Last chance to buy in the current phase

With the supply of new homes running low across the South East, it won’t surprise local house-hunters to see that only one house remains available in the current phase of Riverchapel Wood.

6 The Parade, Riverchapel Wood is situated within walking distance of the scenic Courtown Harbour and many leisure attractions. This developement has proven popular with both homebuyers and investors, with returns almost as attractive as the views!

Number 6 is a spacious three-bedroom semi-detached house in excellent condition throughout, with a bay window and double doors leading onto the rear garden; Asking price €137,000.

For more details on the property, check out the listing on :- http://www.daft.ie/wexford/houses-for-sale/courtown/6-the-parade-riverchapel-wood-riverchapel-courtown-wexford-1354836/

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing.

Behind the Scenes: Kinsella Estates interviewed by Irish Property Developer Magazine

Last month, the team here at Kinsella Estates was nominated for the Littlewoods Ireland Blog Awards 2016 and we were delighted to be shortlisted! In fact, we are the first estate agency in Ireland to ever make the shortlist so huge thanks to the awards sponsors, organsers and everyone who voted. We see this as a signal of interest in property news locally and in the market generally so we are happy to share the information.

Shortly after this, we were asked by Irish Property Developer Magazine to give a behind the scenes look at how we market properties for clients in the digital era. You can read the interview here and feel free to let us know what you think:

Estate Agents: Behind the Scenes

This month Irish Property Developer met with Wicklow and Wexford-based estate agent, Michael Kinsella. Michael continues building the legacy auctioneering practice that his father founded almost five decades ago, together with family members and a team of staff from offices in Gorey and Carnew.

kinsellaestates.ie

- Are the traditional marketing methods e. for sale boards, newspaper advertising etc still relevant when marketing property for sale in today’s market ?

I am proud to say that our family has been serving the local community for over 50 years. Through that 50 years, we have witnessed a big change in the property business in general, and even our own business model. In the early days, for sale boards were the main marketing tool available. We would produce a property brochure in the office, containing the basic information about the property etc. In those days there was no such thing as BER rating’s etc and the information in the brochure was very basic. Buyers would also see properties listed in the window of the office on the main street. We would also place adverts for auctions and houses for sale in the local newspaper, which cost a lot of money back then and took a lot of time and effort.

While there is a perception that buyers only find properties online through property portal websites like Daft.ie or MyHome.ie, the truth is that the traditional ‘For Sale’ are still very effective as a selling tool. These boards have not changed much at all over the years. They are made of corrie-boards and wood. From an agent perspective, they are cost efficient and more importantly, very effective. In addition to attracting attention to the property for sale, they also help us maintain and promote our brand locally. We still use newspaper advertising but definitely not as much as in past times. Property for sale through auction will always be featured in local, and sometimes national, newspapers. We do run regular property adverts in the local paper for certain properties, many times this translates into some editorial coverage of the property in the local newspaper property features.

- How has digital/on-line marketing impacted on the company’s marketing communications strategy ?

We list all properties for sale on Myhome.ie and Daft.ie, and both have had a huge impact on our marketing strategy. While we are based in the South East, we get a huge amount of enquiries through the internet from people living in Dublin and Kildare etc. These sites give our company great reach to a much wider target audience. We have recently launched our brand new website; a huge amount of resources went into doing this well because, as local estate agency, we understand the importance of showcasing our clients’ properties and attracting buyers from outside of our locality. I studied property marketing as part of my Auctioneering Degree and I recognize how critical it is to not only have a website, but that it must be optimized for mobile use. I believe that we have to use the technology available to us, to continually improve our business. Standing still is not an option for any property business today. The marketing focus within the company continues to grow, whereas years ago marketing was just one of many functions that was carried out.

- Does the company have a mobile marketing strategy ? If so, why

is this important?

We do have a mobile marketing strategy. In fact, we have just launched our new website, which has been optimized for mobile usage as we recognise the growing trends away from PC and desktop use towards mobile. The web design company that built the website, 4PM (www.4pm.ie ), also use the latest search engine optimization tools available to ensure that we are always placed high up the search rankings. We have a number of features that we hope to roll out over the coming months, which I don’t want to reveal now, but these features will provide us with a website that will be right up to date in terms of the latest features available. It is important also that our clients know that we have beenhere for 50 years and hope to be here for another 50 years, and the only way we will do that is by continuing to office first-class service to our clients.

- (a)Which of the following on-line/mobile marketing tools does the company use ?

Mobile optimized website Yes Search Engine Optimization (SEO) Yes E mail marketing Occasionally Property portals Yes SMS Only with existing clients & buyers QR codes No Mobile Apps Yes YouTube video platform Yes Yes; Profile & Page Social media Yes Yes

We have a website optimized for mobile devices. We also use search engine optimization. We use the property portals. We use social media and e mail marketing. Our Social Media strategy really started to pay off last year, when we launched a blog on our website. All posts are circulated across our social media platforms. This boosted our likes/followers and fans; more importantly, increased engagement gave us the opportunity to showcase our expertise across the Wicklow and Wexford markets.

In fact, Kinsella Estates were the only Estate Agency in Ireland to be shortlisted for an award in the Littlewoods Ireland Blog Awards 2016. We were delighted to be shortlisted in the ultra-competitive ‘Lifestyle’ category.

(b) Any other ?

We do try all platforms to test and measure what works best, for us that’s the blog and our Facebook page but we are always interested in learning more!

- What are the most important marketing tools from the list above ? Why ?

The property portals are the most important, as I explained earlier. They provide a single market place, where we can list properties cost effectively. We know from experience how successful these sites are at delivering leads and enquiries.

Our website is also an important marketing tool, it also attracts a lot of visitors. It is part of our marketing strategy that it is updated daily, and that content is kept fresh. Research has shown that visitors to a site get frustrated when a site is not updated etc. While this takes time, effort and discipline it has to be done.

- What has been the biggest benefit that the on-line/digital/mobile technologies have brought to marketing residential property for sale ?

The quality of the information that we can present on a property. We can have beautiful digital photography, property videos can now also be uploaded. Brochures can be down loaded from the internet also. Our focus is definitely on video footage at the moment, for both the website and for our social media content.

- How has digital/on-line marketing impacted on relationship with vendors and customers ?

We put a huge amount of resources into marketing Kinsella Estates and marketing the properties we sell. A professional website puts us on an elevated platform with our clients and customers. It showcases our expertise, which gives our company a competitive edge in a very competitive market. Using social media allows us to reach a wider target audience and provides an opportunity to communicate with our customers. Our clients and customers are more knowledgeable nowadays, and they have a higher expectation of the service they want. We strive to meet and surpass their needs, and we are always keen to embrace marketing methods, customer relationship managements tools that enable us to deliver better service to our customers. We are committed to keeping up with technology and property trends; what’s good for our clients is good for the market.