The long term benefits of buying the show house

The question of whether or not buying the show house is a good idea is an on-going debate and certainly, there are pros and cons but experienced buyers know that the long term advantages tend to out-weigh any of the short term disadvantages.

So, what are the disadvantages of buying a showhouse?

You might need to wait for a few months before closing and moving into the property. In other markets, particularly in the US, a buyer might close the purchase and then agree to lease the property back to developer for the sales period, which could be up to two years. This does not happen in the Irish market, in fact, most developments would only use their show house for a few months or a year for phase one. It is common for developers to sell one show house and simply kit out another so two show houses in the space of a year or two years is not unusual and can work well for both the developers and the buyers.

Another perceived disadvantage is that the site adjacent to the showhouse is often used for car parking so it can be busy/noisy at times. Again, this is a very temporary inconvenience.

As anyone who has ever bought a home in the early stages of a new development launch will know, the show house is highly sought after and generally commands a higher price.

What are the advantages of buying a showhouse?

There are multiple reasons for this but the main one is that the show house is generally finished to an excellent quality, beautifully styled and furnished with top end, luxury brands that the developer writes off as a promotion and marketing expense so the full (trade) cost is not passed on to the new buyer.

Also, at a more basic level, all new developments up -sell ‘extras’ that a buyer can pay for if they want a higher specification throughout. This is always demonstrated throughout the showhouse so you can expect that it comes equipped with the highest specification available.

There is nothing standard about a showhouse.

The kitchen, including worktops and light fittings are invariably top quality. This is also true of flooring, however, do remember that what is visually beautiful might not always be practical for families (cream carpeting comes to mind!).

In addition to the high-end finish, showhouses are a feast for interior design enthusiasts with opulent furnishings that a buyer might never be able to buy at the early stages of buying a home. In most cases, the house is sold with everything included, right down to the bed linen, duvet covers and soft furnishings like cushions and table lamps.

Mirrors are a surprising expense for new homeowners and most showhouses use them throughout the house to enhance the light and space available.

Outside the house, the garden is usually architecturally landscaped in a low-maintenance finish (very important for busy families).

In the short-term, showhouses tend not to give new owners the same teething problems as standard new homes as settling cracks are dealt with as they arise – the sales agent will always ensure the showhouse is kept in top condition throughout its use. The same principle applies to snaglist issues. These are generally dealt with as soon as they are identified.

For many buyers, the convenience is irresistible. You can walk into your new home with a only suitcase and there’s no waiting around.

In the long term, as the glossy interior of any home fades over a few years, the showhouse quality will generally stand the test of time.

We are currently listing a former showhouse and the high-quality fit-out is still evident throughout.

1 Woodlands Drive, Gorey, County Wexford is a superb four bedroom detached home and garden, in excellent condition throughout (asking price €235,000).

The property report we’ve been waiting for

Every few months, the team here at Kinsella Estates bring you the round up of property statistics and trends from the previous quarter but this week we have even bigger news. The Central Statistics Office , or CSO, have released a special housing report, based on the latest census figures. This is a big deal as it offers an insight into the market and key measurements that we only get once every five years and for those who have been watching the market over the last five years, you will know that there have been lots of changes – good and bad. This is the first such report since the market started to recover in 2012 and it definitely going to cause a bit of trouble as it contradicts new housing supply numbers released earlier this year by the Department of Housing.

The report covers total housing stock levels, new builds completed and the changing patterns of renting, for example, the trend towards older people renting rather than owning their own home. One Irish Times journalist described it as “a picture of everything we wanted to know about the Irish housing crisis but were too afraid to ask”.

Looking at the 12 months up to March this year, we can see that the overall residential market is up almost 11%. Broken down, this translates into increases in the capital of just over 8% while areas – particularly in the west of the country, which was well behind the recovery we have seen here in the south east – have seen house price growth of up to 20% in the last year. In general, the property market in Ireland is still about 30% below peak levels last seen in 2007.

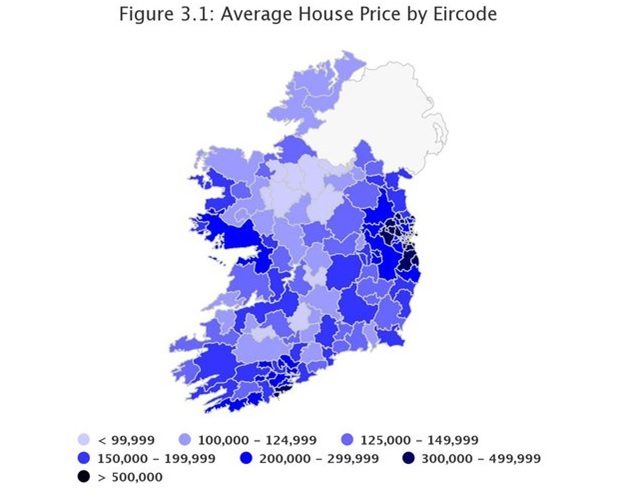

In terms of volume, the total number of homes purchased over the last year (February 2016 to February 2017) is 37,294. What is interesting to note is the breakdown by buyer type; only a quarter of all buyers were first-time buyers and less than a quarter were investors or non owner-occupiers. This means that homebuyers trading up and down, and those buying holiday homes, represent the driving force within the market. People might be surprised to learn that the average home price in Dublin is now €398,319 and it is difficult to believe that that could have been achieved without the relaxing of the Central Bank lending rules last year and the introduction of the controversial Help-to-Buy scheme. The average price paid for a home nationwide is currently €245,165. In County Wicklow, house prices are the highest outside of Dublin, with an average sale price achieved of €313,023. Take a look at the image above (figure 3.1) for an indication of where real progress has been felt and where the recovery has effectively bypassed.

Outlook

While it is not good news for house-hunters, property prices are set to increase by double digits again this year. In fact, Davy Stockbrokers said that 10% is a conservative estimate of future growth this year and the real figure might be much higher. This will come as a great relief to sellers and homeowners currently caught in the negative equity trap but it raises the ugly question: Is double digit growth sustainable without significant development and can buyers truly depend on new supply coming into the market? Unfortunately, there is no single answer to this but as the new homes specialists in counties Wicklow and Wexford, Kinsella Estates are in a good position to help would-be buyers identify new developments coming up locally over the next 18-24 months.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Less than half the population are ‘content’ with their housing

It’s that time of the quarter again, lots of property news, results and price reports. Daft.ie and MyHome.ie are showing average property price increases of almost 10% nationwide. While the average increase is lower across County Wicklow, this is likely due to fewer transactions and those transactions are coming from an already-high value base. County Wexford is picking up speed and this has been one of the busiest quarters that we have seen in years. In general, house prices are up 40% since the bottom of the market – which is great news for sellers and home owners whose property might be in negative equity but not so good for house hunters.

Added to the usual run of house price news, KBC Bank have published their Homebuyer Sentiment survey. These type of survey is few and far between as ‘sentiment’ is more difficult to measure than percentages or euro, but the findings are usually more interesting. And this one doesn’t disappoint. Key findings include the following:

- Only 49% of Irish consumers are content with their current housing

- 23% are not in a position to purchase despite wanting to

- 28% are considering buying within the next two years, with half of these actively house hunting

- Of those currently ready to buy, less than a quarter are investors while the remaining buyers are an equal mix of first-time buyers and those trading up or down

The phrase ‘pent-up demand’ has been thrown around since the confusing days of 2011/2012 and the effects of this have been felt in the market for a few years. Usually we think in terms of people who are either looking to buy or to sell; this survey includes homeowners who are trapped in unsuitable and inappropriate housing.

Interestingly, the survey estimates (based upon their random sampling) that there are approximately 70,000 would-be buyers ready to hit the market, with a total anticipated demand of 300,000over the next two years. While we have sufficient zoned land in parts of County Wexford to deal with short-term future development, the same cannot be said for most of County Wicklow.

All of this activity and these findings are reinforcing the trend for home buyers to look further from the Capital as they search for their future home. Improved road infrastructure right through Wicklow from the M50 to Gorey, just over the Wexford border, makes a 45 minute commute possible from smaller towns like Carnew, Shillelagh and Tinahely. For people looking for a coastal home, Riverchapel, just outside the seaside town of Courtown, will be an increasingly attractive location.

To view a selection of the properties currently available, visit kinsellaestates.ie

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange any viewings.

A Return to Rural Life

What will the Government’s rural action plan mean for sellers in South Wicklow and rural Wexford?

Last month, An Taoiseach, Enda Kenny launched the Government’s rural action plan ‘Realising our Rural Potential: The Action Plan for Rural Development’. This comes after a comprehensive action plan for housing and a longer term housing strategy looking forward Ireland in 2040. That’s a lot of plans! But what do all these plans actually mean, in real terms, if you are thinking of buying or selling a home or investment in rural Ireland over the next few years?

First things first, it has to be said that this is not just a Fine Fail/Fine Gael plan, it has the support of opposition members too, which should mean that it will live beyond the lifetime of the current government – in theory. From the input sought across a range of voluntary bodies and organisations, and the general public, there is clearly the intention to deliver real change for people living and working – or seeking work – in rural Ireland.

The ideas behind the plan are solid; there is a general recognition that there is a massive amount of potential locked away in rural areas. I see this myself in market towns across South Wicklow and County Wexford – there are highly skilled, motivated people who are unemployed or underemployed locally. Also, through my work, I meet people who want to return to their home towns but cannot do this until quality employment becomes available. And it’s not just down to employment; we have to look at the homes available, or the land that needs to be made available for development. I understand that many rural areas, particular in the West and Midlands, are plagued by ghost housing estates that no-one wants to live in, however, here in the Southeast; there is returning demand for available new homes. Local issues for us are more likely to be the derelict homes (with or without existing septic tanks on site) that buyers would be interested in if we could make them affordable and accessible.

The rural action plan aims to integrate existing frameworks of supports and to create new ones with the objective of increasing employment opportunities and access to public services in rural areas to increase the overall quality of life for people.

The plan involves co-ordinating and implementing a huge range of initiatives – there are 276 actions proposed – all to enhance the ‘economic and social fabric’ of rural Ireland. These initiatives focus on rural enterprise, tourism, culture, creativity and improving infrastructure and connectivity. It still sounds a bit vague, doesn’t it?

Here are the specifics:

- 135,000 new jobs to be created by 2020

- Increasing Foreign Direct Investment by 40% in regional areas

- Rejuvenation of 600 rural towns

- Pilot scheme to encourage town and village-centre living

- 12% targeted increase of rural tourism

- Acceleration of high-speed broadband in rural areas

- Protection of vital services (like GPs) in small towns

- 3,200 new Garda members and community CCTV

What this means for owners of vacant, boarded up commercial properties is that it might just be time to start taking the boarding down. With grants and schemes coming on-stream to support local enterprise, vacant retail and office units will be in demand once more. The Housing Department are currently looking at rolling out a rates alleviate scheme, which would be great for commercial landlords and tenants, but we do not yet have any details.

Of interest to owners of vacant – even derelict – residential properties, renovation grants are now available to restore properties in rural communities. This will attract home buyers, particular returning emigrants, back to their home towns. They can apply for a cash grant, not a tax rebate, of approximately €20,000 to purchase and renovate homes in villages and small towns. Uniquely, this scheme will be available to all home buyers, not just first-time buyers. It is particularly aimed at old people living alone in isolated areas, it is hoped that many will accept the benefit of this incentive and refurbish town and village-centre houses. This makes absolute sense for most people, allowing them to feel safer and more included within the everyday activities of the community.

Also, investors might be interested to learn of the Buy & Renewal Initiative, which allows local authorities and approved housing bodies to purchase buildings in need of refurbishment for the purpose of social housing. This will come as a timely opportunity for accidental investors, who might have inherited property but have been waiting to off-load it.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Riverchapel Wood: Final house available in current phase

Last chance to buy in the current phase

With the supply of new homes running low across the South East, it won’t surprise local house-hunters to see that only one house remains available in the current phase of Riverchapel Wood.

6 The Parade, Riverchapel Wood is situated within walking distance of the scenic Courtown Harbour and many leisure attractions. This developement has proven popular with both homebuyers and investors, with returns almost as attractive as the views!

Number 6 is a spacious three-bedroom semi-detached house in excellent condition throughout, with a bay window and double doors leading onto the rear garden; Asking price €137,000.

For more details on the property, check out the listing on :- http://www.daft.ie/wexford/houses-for-sale/courtown/6-the-parade-riverchapel-wood-riverchapel-courtown-wexford-1354836/

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing.

Property Selling Season

Earlier this week someone asked me about ‘the selling season’ and I had to stop for a moment and think about it. Certainly, there used to be a traditional selling season at the start of Spring but over the past decade this has definitely fallen away.

At the moment we are still effectively in recovery mode; while it is true the marketplace has improved and we are seeing a greater number of transactions, there is still a bit of uncertainly about. Of course, reading newspaper reports about the Dublin market when you are trying to sell in rural Wicklow, Carlow or Wexford doesn’t help matters!

There are lots of myths about when is the best time to sell but the truth is usually simpler; the best time is when the seller is ready. Of course it’s great if supply and demand coincide but this is not always practical, or even likely. Transactions happen throughout the year. It’s certainly true that Spring is a popular time to sell as the days are getting longer, gardens are in bloom and people are generally around, without the interruptions of summer holidays and the distraction of Christmas. But does that mean you should wait until after Christmas to put your home or investment property on the market? Not necessarily.

There are lots of myths about when is the best time to sell but the truth is usually simpler; the best time is when the seller is ready. Of course it’s great if supply and demand coincide but this is not always practical, or even likely. Transactions happen throughout the year. It’s certainly true that Spring is a popular time to sell as the days are getting longer, gardens are in bloom and people are generally around, without the interruptions of summer holidays and the distraction of Christmas. But does that mean you should wait until after Christmas to put your home or investment property on the market? Not necessarily.

Over the chaos of the past decade, savvy buyers have realised that Winter can be a great time to go house-hunting for many reasons. Firstly, there are fewer competing buyers, secondly, there is a perception that sellers are eager to sell and therefore open to potential discounts. Both of these reasons sound bad for sellers but perhaps not. The truth is, if you need to sell your property this side Christmas, it might financially make sense to price it keenly. If not, you are still assured that there will be fewer time-wasters turning up at this time of the year so while the number of would-be buyers viewing your property might be less than at other times, the quality and intention of those buyers who visit is likely to be stronger. In fact, buyers tend to find the run up to Christmas quite frustrating as sometimes even active sellers with active property listings don’t allow viewing to take place over the festive season. This is never a good idea. Once your property is on the market, it needs to be accessible to finance-ready viewers.

So, my answer to ‘the selling season’ question is simple, sell when you are ready. Trying to time the market will backfire if it’s not the right time for you and your family. But if now is the right time, talk to the team here at Kinsella Estates and we will help get you and your property ready without delay.

With less than two months to go before the end of the year, it is certainly possible to attract a buyer although getting the conveyancing through this side of Christmas might be a challenge. For many buyers and sellers at this time of the year, it is enough to reach agreement and sign Contracts for Sale so that both parties know their plans coming into the New Year. So, if you are looking to bring your home to the market this side of Christmas, it will necessary to be prepared; let your conveyancing solicitor know to take up title deeds and prepare contracts straight away; have your home and garden looking its very best and, most importantly, be ready to accommodate viewings as soon as the property is listed.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact myself (Michael), Alan or Eileen Kinsella at kinsellaestates.ie .

You can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

From the Horse’s Mouth: Housing in Budget 17

Coveney announces transformational housing budget

- 50% increase in housing budget for 2017

- Housing needs of over 21,000 being met in 2017

- Funding for 3,000 exits from emergency accommodation in 2017

- New First Time Buyers initiative – 5% of purchase price, max €20k

The Minister for Housing, Planning, Community and Local Government, Mr. Simon Coveney,T.D., today (11 October 2016) welcomed significant additional funding allocated for 2017 to underpin Rebuilding Ireland the Government’s Action Plan for Housing and Homelessness. In Budget 2017, the Government is allocating €1.2 billion to housing programmes, a 50% increase over 2016. Thi

The Minister for Housing, Planning, Community and Local Government, Mr. Simon Coveney,T.D., today (11 October 2016) welcomed significant additional funding allocated for 2017 to underpin Rebuilding Ireland the Government’s Action Plan for Housing and Homelessness. In Budget 2017, the Government is allocating €1.2 billion to housing programmes, a 50% increase over 2016. Thi

s investment will see the housing needs of over 21,000 households being met in 2017. In addition, local authorities will fund a range of housing services to the value of €92 million from surplus Local Property Tax receipts, bringing the total housing provision in 2017 to almost €1.3 billion.

Speaking after Budget 2017 was announced, Minister Coveney said:

“What I am announcing today represents a transformational budget for housing in Ireland. I said at the launch of Rebuilding Ireland in July that meeting the housing challenge is the key priority for this Government. The package of measures I am announcing with Cabinet colleagues demonstrates the extent of that commitment. The investment provided by the Exchequer and by local authorities will allow us to meet the housing needs of 21,050 families in 2017. As part of this, I am providing an increase of €28m in funding for homeless services, underscoring the particular priority I attach to this issue, including the provision of emergency supports for rough sleepers and ending reliance on the use of hotels for homeless families by mid-2017.

The Budget also contains a comprehensive package of supports for the wider housing market in terms of a significant tax rebate for first time buyers to stimulate the supply of new homes; extension of mortgage interest relief for existing homeowners; and changes to Capital Acquisitions tax The rented sector is a key focus under Rebuilding Ireland and in this Budget we have introduced a number of important supply incentives including improvement in mortgage interest relief for landlords, increase in the ceiling for the rent-a-room scheme, extension of the Living City initiative to rental properties and supports for new student accommodation. This is in advance of the delivery of a comprehensive strategy for the rental sector which I will publish before the end of the year.

Total funding for my Department in 2017 is €1.78 billion compared to €1.38 billion this year. This includes €702m in capital funding – an increase of 48% on 2016 and €1,075m in current funding which is an increase of 18% on this year. Overall, the increase of €394m or 28% on 2016.The bulk of the increase is going to housing which is the Government’s number one priority issue. An additional €2m is also being provided in 2017 for the RAPID programme for disadvantaged areas and a new Community Facilities Fund is being included, with an initial €2m being provided in 2017.

The proposed Department Vote 2017 is €1.777 billion (€702m Capital and €1,075m Current) an increase of nearly 30% since 2016 (€1.383 billion).”

Detailed breakdown of each sector

Housing Delivery

- The total exchequer Housing allocation in 2017 will be €1.2 billion. This is broken down into €655m in capital and €566m current funding.

- This compares to €814m in 2016 (€432m Capital, €382m Current). This is an increase in the total Exchequer allocation for housing of €400m, which represents a 50% increase over 2016.

- Local Authorities will also provide funding for Housing in 2017 (LPT self-funding) amounting to €77m Capital and €15m Current. This will bring overall housing allocation to 1.3bn

- Funding under the Housing Programmes will deliver 21,050 units in 2017 through the full range of social housing supports.

- Increased funding for the provision of housing adaptation grants will enable some 9,000 grants to be made in 2017, thereby assisting older people and people with a disability to remain in their own homes and communities.

- Capital of €9m is to be provided in 2017 for Traveller-specific accommodation, an increase of 64%, which will also support the carrying out of fire safety works in traveller accommodation.

- An additional 400 dwellings have been targeted for Pyrite remediation in 2017 through investment of €22 million.

Capital

A total capital provision of €732m (Exchequer provision up 51% on 2016) has been allocated in 2017 and will support the delivery of 4,450 units through the Local Authority and AHB construction and acquisitions programme. This also includes Rapid Builds, units to be delivered through Part V mechanisms, returning vacant units to productive use and delivery of new units under the National Regeneration Programme.

Current

A total provision of €581 million has been allocated in 2017 and will support the delivery of 16,600 units through:

- An allocation of €152.7m (+€105m on 2016) for the Housing Assistance Payment which will enable a further 15,000 households to be accommodated and also support the ongoing costs of 17,000 existing HAP tenancies;

- Funding of €134 million will support a further 1,000 new transfers under the Rental Accommodation Scheme; and

- An increased funding provision of €84 million (+€27m on 2016) under the Social Housing Current Expenditure Programme will support the delivery of 600 direct leased units in 2017. In total, 2,250 units will be delivered in 2017 under the Social Housing Current Expenditure Programme

Homelessness

- A 40% increase in homeless funding from €70m this year to €98m in 2017 will ensure that the increased demand for emergency homeless services is effectively addressed and will assist in supporting homeless households with long term and sustainable housing solutions.

- The increased budget reflects the additional costs of emergency accommodation and homeless services until the housing and homelessness actions & initiatives in Rebuilding Ireland results in hotels only being used as emergency accommodation in limited circumstances by mid-2017.

- In 2017 through a range of funding mechanisms, there will be provision for 3,000 exits from emergency accommodation achieved through mainstream social housing tenancies, rapid build houses and the Housing Assistance Payment.

- The increased budget will assist towards the tripled target of moving 300 people from homelessness into supported tenancies in the Dublin region through the Housing First programme and its extension to other major urban areas.

- These measures will be supported by increased funding in the areas of mental health and addiction from the Department of Health and additional supports for children and families in from the Department of Children & Youth Affairs.

Increasing Supply

First Time Buyers – Help-to-Buy, Mortgage Interest Relief, CAT

- 5% tax rebate for first time buyers of new builds up to €400,000. This is a supply side driver that will be available from 19 July to end 2019

- Maximum rebate of €20,000 applies to properties from €400,000 to €600,000.

- No rebate for properties above €600,000.

- Extension of mortgage interest relief beyond 2017.

- Increased threshold from €280,000 to €310,000 for transfers from parents to children in respect of Capital Acquisitions Tax.

Local Infrastructure Housing Activation Fund

- €200m fund to relieve critical infrastructural blockages and enable the delivery of large scale housing on key development sites.

- This has the potential to open up lands and deliver housing of the order of 15,000 to 20,000 units by 2019.

Planning

- Additional funding is being provided to An Bord Pleanala to support implementation of the new fast-track measures for streamlining the application process for large residential developments, in line with commitments in Rebuilding Ireland.

Bringing vacant properties back into use

Housing Agency Rotating Fund

- The Housing Agency is being provided with €70m capital funding to engage with banks and investment companies to acquire properties for social housing nationally. This will deliver 1,600 units over the period to 2020.

Repair & Leasing Initiative

- New Repair and Leasing Initiative will allow local authorities to provide financial assistance to property owners to bring vacant properties up to standard which can then be leased for social housing. Capital provision of €6 million in 2017 will deliver 150 units under this new initiative.

Buy & Renew Initiative

- A new Buy and Renew initiative will support local authorities and approved housing bodies to purchase private housing units in need of remediation, renew them and make them available for social housing use. An initial capital provision of €25 million will be available for this initiative in 2017.

Living City Initiative

- Changes designed to increase uptake. Maximum floor area restriction is being removed. Requirement for properties to have been used as residential dwelling to avail of support is also being removed, and qualification thresholds are being changed.

Local authority voids

- 800 vacant units will be brought back into use in 2017.

Supporting the Rented Sector

- Mortgage Interest Relief to be fully restored from 75% to 100% over a five year period. Increasing from 75% to 80% in Budget 2017.

- Extension of Living City Initiative to landlords to support investment in rented market.

- Rent a Room ceiling increased from €12,000 to €14,000.

- Strategy for the rental sector will be delivered by end 2016 – work underway at present.

Student Accommodation

- New ISIF support for new investment in student accommodation

- Rent a Room ceiling increased from €12,000 to €14,000

- Higher Education Institutions accessing low cost loan finance from the Housing Finance Agency.

Home Renovation Incentive

- 2 year extension of relief until end 2018 to allow homeowners avail of income tax credit of 13.5% incurred on repair, renovation, or improvement work carried out on residential dwelling.

Community

- €78.2m is provided in 2017 for Community Programmes (€9.6m Capital and €68.6m current) – an increase of 10% on 2016.

- The bulk of the funding relates to Supports for Community and Voluntary Sector (€12.3m) and SICAP (€42.4m).

- Additional funding is being provided in 2017 for the RAPID programme (€2m) and a new Community Facilities Fund (€2m)

Water Services

- €46.5m (Capital €23m and Current €23.5m) is being provided in 2017.

- The bulk of the Capital funding (€17.8m) relates to the Rural Water Programme

- Current funding is provided to support initiatives under the Water Quality Programme. The main focus of this programme is to provide funding for Water Quality, primarily the investment in statutory environmental and public health compliance.

Local Government

- €385m is provided in 2017 under Local Government Programmes (€8.5m Capital and €376.6m Current)

- The Capital expenditure relates to Fire and Emergency Services

- Current Expenditure relates to Franchise (€1.4m), Fire and Emergency Services (€800k) and a payment from the Exchequer to the LGF of €365m

ENDS