Budget 2020

Yesterday was a busy day in the media and the Budget 2020 will be talked about in the days ahead with people agreeing or disagreeing on some of the changes. The budget didn’t offer second-hand home buyers any new initiatives but it did offer new home owners a helping hand with the extension of the Help-to-Buy scheme.

In terms of winners and losers, one win was as mentioned, the Help-to-Buy scheme extension, the additional funding to homelessness services and the announcement that the Government is prepared for Brexit with funding available to offset the challenges to come. It is good news for those who are worrying about the impact of Brexit on their business but not nearly enough for people who were expecting more from the Budget.

Motorists have been hit with an increase in carbon tax (which came into effect last night) on auto-fuels but there will be an increase for other fuels once winter is over, in May 2020. In other news, the Government are striving to move away from diesel cars to more emission friendly, hybrid or electric cars with the new NOx tax which will impact new and imported cars. For those who drive a lot, or for companies who have a lot of drivers on the road this will be a blow to their tight budgets. This could also slow down the new car market with little enticement to buy a new car.

The Government announced the increase in stamp duty on commercial property purchases from 6% to 7.5% and it could cause some problems with the commercial property market though it will bring in plenty of millions in stamp duty revenue. This increase signifies the second one in three budgets and it was only back in 2018, when Minister for Finance, Paschal Donohoe trebled the rate of 2% to 6% causing an uproar so this is another blow to the property industry. The Minister reportedly considers this possible as the Irish commercial property market is apparently, strong.

In other sectors, tourism didn’t get any reprieve from last year’s increase in VAT from 9% to 13.5% though they had been expecting some reversing of the hike last year. Unfortunately, it wasn’t to be but craft beer producers were happy as production threshold (that qualifies for tax relief) has been raised from 40,000 hectolitres to 50,000. Smokers saw another increase from the Government adding an extra 50 cents to a pack of cigarettes. There was little in Budget 2020 for families but there was €13 million allocated for the warmer homes scheme to provide free energy efficiency upgrades to households at risk of energy poverty. Prescription charges were dropped by 50 cent and Free GP care for children under eight and free dental care for children under six from September was announced.

You can read the full speech here and read more in detail about Budget 2020.

The property report we’ve been waiting for

Every few months, the team here at Kinsella Estates bring you the round up of property statistics and trends from the previous quarter but this week we have even bigger news. The Central Statistics Office , or CSO, have released a special housing report, based on the latest census figures. This is a big deal as it offers an insight into the market and key measurements that we only get once every five years and for those who have been watching the market over the last five years, you will know that there have been lots of changes – good and bad. This is the first such report since the market started to recover in 2012 and it definitely going to cause a bit of trouble as it contradicts new housing supply numbers released earlier this year by the Department of Housing.

The report covers total housing stock levels, new builds completed and the changing patterns of renting, for example, the trend towards older people renting rather than owning their own home. One Irish Times journalist described it as “a picture of everything we wanted to know about the Irish housing crisis but were too afraid to ask”.

Looking at the 12 months up to March this year, we can see that the overall residential market is up almost 11%. Broken down, this translates into increases in the capital of just over 8% while areas – particularly in the west of the country, which was well behind the recovery we have seen here in the south east – have seen house price growth of up to 20% in the last year. In general, the property market in Ireland is still about 30% below peak levels last seen in 2007.

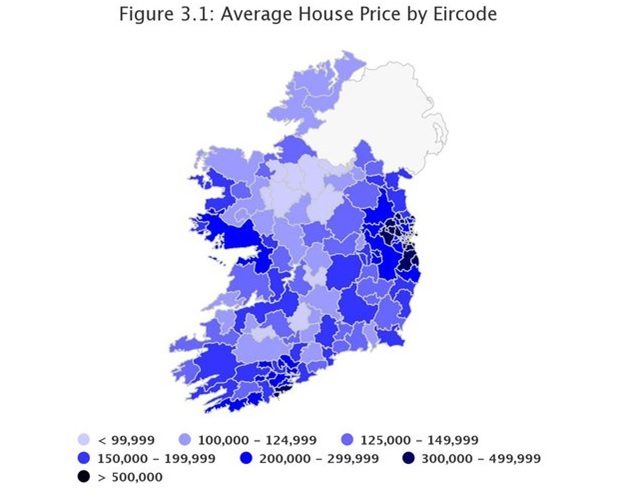

In terms of volume, the total number of homes purchased over the last year (February 2016 to February 2017) is 37,294. What is interesting to note is the breakdown by buyer type; only a quarter of all buyers were first-time buyers and less than a quarter were investors or non owner-occupiers. This means that homebuyers trading up and down, and those buying holiday homes, represent the driving force within the market. People might be surprised to learn that the average home price in Dublin is now €398,319 and it is difficult to believe that that could have been achieved without the relaxing of the Central Bank lending rules last year and the introduction of the controversial Help-to-Buy scheme. The average price paid for a home nationwide is currently €245,165. In County Wicklow, house prices are the highest outside of Dublin, with an average sale price achieved of €313,023. Take a look at the image above (figure 3.1) for an indication of where real progress has been felt and where the recovery has effectively bypassed.

Outlook

While it is not good news for house-hunters, property prices are set to increase by double digits again this year. In fact, Davy Stockbrokers said that 10% is a conservative estimate of future growth this year and the real figure might be much higher. This will come as a great relief to sellers and homeowners currently caught in the negative equity trap but it raises the ugly question: Is double digit growth sustainable without significant development and can buyers truly depend on new supply coming into the market? Unfortunately, there is no single answer to this but as the new homes specialists in counties Wicklow and Wexford, Kinsella Estates are in a good position to help would-be buyers identify new developments coming up locally over the next 18-24 months.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

A Return to Rural Life

What will the Government’s rural action plan mean for sellers in South Wicklow and rural Wexford?

Last month, An Taoiseach, Enda Kenny launched the Government’s rural action plan ‘Realising our Rural Potential: The Action Plan for Rural Development’. This comes after a comprehensive action plan for housing and a longer term housing strategy looking forward Ireland in 2040. That’s a lot of plans! But what do all these plans actually mean, in real terms, if you are thinking of buying or selling a home or investment in rural Ireland over the next few years?

First things first, it has to be said that this is not just a Fine Fail/Fine Gael plan, it has the support of opposition members too, which should mean that it will live beyond the lifetime of the current government – in theory. From the input sought across a range of voluntary bodies and organisations, and the general public, there is clearly the intention to deliver real change for people living and working – or seeking work – in rural Ireland.

The ideas behind the plan are solid; there is a general recognition that there is a massive amount of potential locked away in rural areas. I see this myself in market towns across South Wicklow and County Wexford – there are highly skilled, motivated people who are unemployed or underemployed locally. Also, through my work, I meet people who want to return to their home towns but cannot do this until quality employment becomes available. And it’s not just down to employment; we have to look at the homes available, or the land that needs to be made available for development. I understand that many rural areas, particular in the West and Midlands, are plagued by ghost housing estates that no-one wants to live in, however, here in the Southeast; there is returning demand for available new homes. Local issues for us are more likely to be the derelict homes (with or without existing septic tanks on site) that buyers would be interested in if we could make them affordable and accessible.

The rural action plan aims to integrate existing frameworks of supports and to create new ones with the objective of increasing employment opportunities and access to public services in rural areas to increase the overall quality of life for people.

The plan involves co-ordinating and implementing a huge range of initiatives – there are 276 actions proposed – all to enhance the ‘economic and social fabric’ of rural Ireland. These initiatives focus on rural enterprise, tourism, culture, creativity and improving infrastructure and connectivity. It still sounds a bit vague, doesn’t it?

Here are the specifics:

- 135,000 new jobs to be created by 2020

- Increasing Foreign Direct Investment by 40% in regional areas

- Rejuvenation of 600 rural towns

- Pilot scheme to encourage town and village-centre living

- 12% targeted increase of rural tourism

- Acceleration of high-speed broadband in rural areas

- Protection of vital services (like GPs) in small towns

- 3,200 new Garda members and community CCTV

What this means for owners of vacant, boarded up commercial properties is that it might just be time to start taking the boarding down. With grants and schemes coming on-stream to support local enterprise, vacant retail and office units will be in demand once more. The Housing Department are currently looking at rolling out a rates alleviate scheme, which would be great for commercial landlords and tenants, but we do not yet have any details.

Of interest to owners of vacant – even derelict – residential properties, renovation grants are now available to restore properties in rural communities. This will attract home buyers, particular returning emigrants, back to their home towns. They can apply for a cash grant, not a tax rebate, of approximately €20,000 to purchase and renovate homes in villages and small towns. Uniquely, this scheme will be available to all home buyers, not just first-time buyers. It is particularly aimed at old people living alone in isolated areas, it is hoped that many will accept the benefit of this incentive and refurbish town and village-centre houses. This makes absolute sense for most people, allowing them to feel safer and more included within the everyday activities of the community.

Also, investors might be interested to learn of the Buy & Renewal Initiative, which allows local authorities and approved housing bodies to purchase buildings in need of refurbishment for the purpose of social housing. This will come as a timely opportunity for accidental investors, who might have inherited property but have been waiting to off-load it.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Building for the Future

Originally published in the Gorey Guardian, December 10, 2016.

The busy construction team at Gleann an Ghairdin, the new estate being built on the Ballytegan Road, Gorey, recently hosted a group of fifth year construction studies students from Gorey Community School.

Accompanied by their teacher, Pat Hegarty, the 20 students were given a full tour of the site which is being developed by local builders Wexford Low Energy Homes. The development is made up of three-bedroom semi-detached and detached A-rated houses.

The students were shown around the site by selling agent, Michael Kinsella of Kinsella Estates and Nicky Morrissey from Wexford Low Energy Homes. They were shown houses at different stages of construction and saw foundations being poured, inspected houses being roofed, and viewed those being prepared for plumbing and electrical fittings.

Finally, the students became the first Gorey residents to look inside the showhouse on site before it opens to the public next week.

As construction was ongoing while the group was on site, safety was paramount and the students were kitted out with safety gear and got a practical lesson in safe on-site behaviour.

Foreman Nicky answered questions on every aspect of the build. The specialist low-energy home builders are using technology that the students would only have read about.

‘They were really engaged,’ said Michael Kinsella. ‘Many had never seen the inside of a building in progress. A site visit like this opens their eyes to new technologies and new ways of building for the future.’

This site visit comes at a time when the construction industry is struggling to fill jobs at all skill levels and is actively trying to promote the apprenticeship route for future tradespeople and construction-related third level courses for those who are college and university-bound.

‘It was excellent. I was really impressed with Nicky,’ said teacher Pat Hegarty. ‘The class had prepared questions for afterwards but he answered all of their questions during the tour.’

The showhouse will open for viewings on Saturday, December 10, from 1.30 p.m. to 3 p.m. See kinsellaestates.ie for more.

Helping buyers get their dream homes

Here at Kinsella Estates we love what we do and the best part of our day is when we hand new buyers the keys to their dream home!

“Thank you for all work in getting us the keys to our new home.

Michael was very professional and always went above and beyond for us always

The staff in the office were brilliant and always got back to us.

We would highly recommend Kinsella Estates to anyone buying a new or second home.”

Budget 2017 for Property Buyers and Sellers

Property Measures Announced in the Budget

We knew in advance of Budget ’17 that housing was going to be a priority so Michael Noonan’s budget speech contained very few surprises, if any, for the sector.

In an earlier post, I detailed the Government’s Action Plan for Housing: Rebuilding Ireland. This plan sets out the housing problems to be tackled and steps that will be taken. While the issues are broken up into five categories or ‘pillars’ they all come back to one common underlying problem, that is, the chronic lack of supply across all housing sectors from social to private to rental. Developers and members of the construction industry have blamed the cost of building and budgetary measures were definitely needed to address this. Unfortunately, this is not what we got on Budget Day. Instead, we got a grant – by way of tax rebate – for first-time buyers purchasing newly built homes only.

In an earlier post, I detailed the Government’s Action Plan for Housing: Rebuilding Ireland. This plan sets out the housing problems to be tackled and steps that will be taken. While the issues are broken up into five categories or ‘pillars’ they all come back to one common underlying problem, that is, the chronic lack of supply across all housing sectors from social to private to rental. Developers and members of the construction industry have blamed the cost of building and budgetary measures were definitely needed to address this. Unfortunately, this is not what we got on Budget Day. Instead, we got a grant – by way of tax rebate – for first-time buyers purchasing newly built homes only.

This help-to-buy scheme for first-time buyers will give a rebate of income tax (already paid) of 5 per cent of the purchase value of a newly-built home, up to a value of €400,000. That translates to a maximum rebate of €20,000 in cash. Properties costing from €400,000 to €600,000 will qualify for the €20,000 rebate, but the scheme will not apply to homes over €600,000 in value. This is a temporary measure only, backdating to July 19th last and will run until the end of 2019. In practical terms, buyers of a new house costing €300,000 will qualify for a rebate worth €15,000, however, they will still need their €23,000 deposit (under the Central Bank rules) and they must have a combined income of €75,000.

While the rebate is designed to offset the cost of higher deposits required from first-time buyers, and in turn boost demand, it has been perceived by members of the sector as a grant to the developer. Irrespective of the designed purpose, in real terms, this is the least effective way to stimulate supply and is likely to simply increase prices for first-time buyers already struggling to afford their first home.

While the first-time buyer initiative has been deeply criticised across the industry, at least there was some attempt to address their concerns. Those stuck in rental situations were not so lucky. At best, the help-to-buy scheme will create get a small portion on renters out of this market and into their own homes, and this should free up some rented accommodation.

Other Property Measures

Other Property Measures

- Residential investors/landlords received a 5 per cent increase in their mortgage interest relief, from 75 per cent to 80 per cent in 2017 and this is expected to increase annually until it reaches 100 per cent again.

- The Home Renovation Incentive Scheme was extended further by two years, bringing it up to the end of 2018.

- The Rent a Room scheme had its tax-free income ceiling here has increased by €2,000 annually to bring it up to €14,000.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact myself (Michael), Alan or Eileen Kinsella at kinsellaestates.ie or email me directly on michael@kinsellaestates.ie and telephone: +353 53 94 21718

Helping Returning Buyers

Unsurprisingly, the past decade has seen massive emigration from Ireland. But the movement of people does not affect all areas equally. Not only are younger rural dwellers more likely to emigrate, but those who remain are more likely to move from their local areas into larger towns and cities. This effectively shifts the population away from rural areas into the main cities and, in the past, the only way to halt or reverse this was to encourage large-scale employment in the rural areas. But as the economy recovers, this trend is starting to shift slightly. In the last year or two, we are starting to see the return of our more recent emigrants. Specifically, we are starting to see these people – who are or have been working on contract basis in the high-tech or telecommunications sectors in Australia or Asia – plan a return to Ireland. For some, the move to Ireland is immediate, for others, they will work abroad for another few years before returning permanently. For many, they will continue in their contract roles, with their existing employers after they return to Ireland. As remote workers, they can generally work from anywhere in the world.

These buyers are typically Irish, or with an Irish partner, living and working overseas for much of the past decade and with cash savings in excess of €50,000. Many have multiples of this amount and do not require any mortgage funding. While these buyers do not appear in national statistics as first-time buyers, they usually are, and they appear as investors, despite buying the homes to eventually live in themselves.

What most returning buyers want is a property that will work as a good investment initially until they return to Ireland, at which time they need it to function as a home for some length of time. This is a tricky balance to achieve. Generally, a suitable family home will be more expensive than suitable rental home but will not achieve a higher rental income. Similarly, an affordable rental/investment property might not be in the type of setting that makes a long-term family home. There is certainly a fine balance with this, and when added to the fact that these buyers tend to be researching and buying while still overseas, the process can be difficult. One of the major challenges experienced by buyers overseas is that some auctioneer firms are reluctant to engage with them or to accept bids from ‘unknown’ bidders. This can be frustrating for buyers, especially for those who are unable to get back to Ireland on a regular basis. The technology exists for buyers to see the area, the street, the property and full 360 degree views of every nook and cranny internally; booking deposits can be transferred on-line; buyers, together with their solicitors, can complete a Power of Attorney to facilitate conveyancing… There is no reason not to deal with buyers in Australia in much the same way as we would deal with buyers who walk into our offices!

Here at Kinsella Estates, we understand that returning buyers have enough on their plates without trying to master the finer details of sourcing an investment property as compared with house-hunting for their family home. We now have a dedicated team member, Aisling, who will be helping remote buyers work through their buying requirements, she can carry out viewings on their behalf and unlike other estate agencies, we have adopted a policy of accepting bids from qualified remote buyers. By ‘qualified buyers’, we are referring to those who have supplied us with proof of identification, as required to satisfy anti-laundering legislation, and proof of funds.

If this is something that you need or are interested in finding out more about, contact Aisling in our office or you can email me directly on Michael@KinsellaEstates.ie with your Skype (or similar) contact details.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie.

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Kinsella Estates: Buyers’ Guide to the Pre-Purchase Structural Survey

mandatory but buyers are generally advised to get one. The survey is an independent evaluation of the overall condition of a property and lists all and any issues or ‘defects’.

|

External Areas

|

Internal Areas

|

Other

|

|

Roof and chimneys

Guttering and

flashing

Settlement cracks

Movement in

foundations

Windows and doors

Drainage

Boundaries

Path and driveway

|

Interior attic space

Ceilings and floors

Interior walls

Windows and doors

Heating system

Plumbing and

electrics

Working fireplaces

Ventilation and

damp

Insulation

|

Compliance with

Building

Regulations

Boundary

infringements

Boundary

conditions

|

Once again, if you are in doubt, speak to your surveyor after the issue of the report to clarify: (1) If there are any unexpected defects that are inconsistent with the age of the property and, if so, (2) Is that a reason not to proceed with the purchase?

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie.

EAST COAST FM: Thank You

Huge thanks to everyone who came along and supported our East Coast FM Coffee Morning to raise money for cancer services throughout County Wicklow. I am delighted to say that the team here at Kinsella Estates, together with our clients and friends raised €960 so far, with more money still coming in daily.

This is a great sum raised for a great cause – we were delighted to get involved this year and genuinely appreciate the support locally.

Thank you all,

Michael, Eileen and the team here at Kinsella Estates

East Coast FM Annual Coffee Morning: Join us and help cancer services in County Wicklow

Kinsella Estates are proud to be taking part in the 8th annual East Coast FM, Wicklow-wide, Coffee Morning tomorrow (Friday, April 8th) at our offices on Main Street, Carnew from 10 am to midday.

All money raised goes to fund cancer support services across County Wicklow, with five cancer support centres and the Wicklow Hospice Foundation.

Please show your support tomorrow, help us spread the word, join us for a coffee and bring a friend!

A word from organiser, Claire Dermody, Producer of The Morning Show, on East Coast FM:

“Over the last 7 years, the amazing people of Wicklow have helped East Coast FM raise over €268,000 for these very important local charities and we really hope they can help again.

This years event takes place on Friday 8th April from 10am to midday coffee mornings will take place in eleven different venues around the county, all people need to do to take part is drop into one of the venues, have a coffee and make a donation and enjoy the entertainment.”

In addition to the Kinsella Estates coffee morning, events are taking place in the following locations:

- The Martello, Bray

- The Beach House, Greystones

- Kavanaghs, Vartry House, Roundwood

- The Food Café at Fishers, Newtownmountkennedy

- Avoca Café, in Mount Usher, Ashford

- Riverbank Café and Bistro Bridgewater Shopping Centre, Arklow

- The Grand Hotel, Wicklow Town

- The Kingfisher’s Kitchen, Enniskerry

- West Wicklow House, Blessington

- Avondale Sports, Rathdrum Main Street

- Lawless’s Hotel, Aughrim