Wexford House Price Increases Among Highest in Ireland

Key highlights from the latest Daft.ie property price report, October 2017:

- House prices are currently rising at a rate of €50 per day (no typo, that’s per DAY)

- Wicklow prices are up 9.9%, with an average house price of €315,994

- Wexford prices are up 11.4% – rising at a rate higher than most of the country – with an average house price of €195,480

- Stock shortage of all types of residential properties continue; unless new supply becomes available, prices will continue to rise

- Surprisingly, the increase seen between June and September this year was the smallest nationally since prices bottomed out in late 2013

- In the final nine months of 2016, approximately 15% of transactions related to newly built homes. In the first nine months of 2017, the rate is slightly higher at 17%

daft.ie House Price Report: Q3 2017 – An infographic by the team at daft.ie

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Ireland’s Residential Property Price Barometer (IPAV)

Earlier this week, the Institute of Professional Auctioneers & Valuers (IPAV) for Ireland published their ‘Residential Property Price Barometer’, which gives a breakdown of prices for two-bed apartments, three-bed semis and four-bed semis across every county in Ireland. According to this most recent research, the cost of an average family home in Dublin is now €527,894 – more than double that of the national average three-bed at €253,466. Wicklow remains the most expensive area outside of Dublin, followed by Kildare and Meath. Counties Longford, Sligo and Leitrim recorded the lowest house prices nationally.

The current average prices for County Wicklow and County Wexford are as follows:

On average, two-bed apartments in County Wicklow are coming in at €202,750, the highest apartment prices outside of Dublin by quite a significant margin. Three-bed semis are achieving an average of €275,591, while four-bed semis are making €344,036.

Similarly, across County Wexford, two-bed apartments are achieving an average sale price of €83,334, with three-bed semis making €145,000 and the four-beds getting, on average, €171,667.

The stand-out surprise is the unexpectedly strong performance of Wicklow apartments. Of course, we know that lack of available stock – in particular, houses – and delays with any new stock coming to the market is still the driving force behind the rising prices. Construction across the country, including the South East region, is nowhere near the level required at this stage. While the industry is set to deliver up to 20,000 homes per year by 2018 (which is up from just 12,666 in 2015), this is not happening quickly enough to meet current or immediate demand within the commute region.

As we watch for the delivery of new homes, it is worth reflecting on changing buyer trends in recent years. For example, here at Kinsella Estates, we can see that house-hunters have never been more organised, better researched or as familiar with the market as this current generation of buyers are. They are knowledgeable and well-informed, however, their expectations of quality and energy efficiency are much higher than their predecessors and developers need to be mindful of this.

With such a dearth of new homes available, particularly here in South Wicklow and North Wexford, it makes sense for home buyers – whether they are looking for their first home, trading up or perhaps downsizing by the coast – to consider purchasing a second-hand home.

Traditionally, September has always been the height of the selling season. Over the past decade, the market has definitely become less seasonal and more opportunistic. The reality is that homes coming to the market locally are being presented to known buyers. Through our offices in Carnew and in Gorey, we know buyers who have been looking for the last few months and when we visit a home to appraise it for sale, very often, we have a good idea of who the buyer is likely to be. This can help speed up the sale process, which is good news for the seller, but more importantly, by knowing the buyer, their budget and their capacity to close the deal, we can add a greater degree of certainty at a time when sellers need it most.

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Tips for summertime property sellers

Don’t you just love when summer arrives right at the moment it’s due?

It’s certainly a rarity in Ireland – although here in Ireland’s sunny South East we can boast the most hours of sunshine per year compared with any other part of the country. That is probably why sales transactions soar in summertime. In fact, in last weekend’s Sunday Business Post newspaper, a report on commuter counties placed both Wicklow and Wexford high on the list of buyers’ destinations, with recorded increases of 17% and 13% respectively. Carlow, Kilkenny and Waterford have all seen reductions in demand over the last 12 months. This makes for an interesting time in South Wicklow and Wexford county right now as demand increases by supply has yet to catch up. House-hunters, especially those looking for family homes will need to widen their search areas/criteria and be prepared to engage in competitive bidding.

The real opportunity exists for sellers of second-hand homes and those thinking about bringing a residential property to the market over the next few weeks and months.

For existing sellers who are waiting for the right buyer to come along, it might be worth going through the tips below and freshening up their homes and perhaps update the property listing and photos online.

Tips for summertime property sellers:

- The notion of ‘kerb appeal’ is a cliché but that doesn’t make it any less relevant. The initial impression that your home creates as a potential buyer pulls up is difficult to change so it’s important that the impression is the best one possible. This applies to the photos that appear online also. They should be clear, bright and clear of clutter.

- As a rural estate agency, we understand the importance of giving good, clear directions to your home. Eircode has not been hugely successful but marking properties on a digital map makes it easy for house-hunters to use GPS when arriving for a first viewing. That’s our job. As the seller, it’s your job to ensure that if your property has a house name or number, that it is clearly marked. If would-be buyers get lost trying to find your property, by the time they arrive, late, they will be too stressed and frustrated to fully appreciate the presentation of your home.

- The front door should be thoroughly cleaned or freshly painted and clear of dust and cobwebs. Choose the colour well, be sure to reflect the tone of your home for example, yellow for youthfulness, blue for calm and red for a warm welcome! If possible, the entire front of the house should be freshened up but we understand that this is not always possible.

- Following on from the point above, if resources are limited, allocate them wisely; concentrate on the areas that will have the most impact. For example, wash the windows and scrub or repaint window frames.

- Tidy the front garden, sweep pathways, trim hedges and pull weeds. If flowers are not an option, invest in a few well thought out planters to add colour and to create an abundant feel. Put wheelie bins away, out of sight if possible.

- Treat your entrance like a room of its own with a good design, clutter-free, and with some light furnishing or focal piece – like a hall table with flowers (and nothing else!).

- Once inside, continue the fresh, clutter-free theme and remove unnecessary, bulky furnishings. In fact, this might be the right time to start preparing for your impending move.

Here at Kinsella Estates, we offer a free sales appraisal and with this, we offer key suggestions about how to best present your property to suit the type of buyer your home is likely to attract. Contact us directly to discuss your home and to arrange an appraisal.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

What house-hunters are REALLY looking at when viewing your home

Forget the smell of home baking or fresh coffee brewing, a recent survey of house-hunters reveal that a surprisingly high figure of 95% will walk straight to the property’s windows to find out what the view is like.

This research is the first of its kind as it equipped house-hunters with eye-tracking goggles that recorded where people viewed, how often they returned to the same spot and how long they spent in any part of the room.

Now that I think about it, it makes complete sense. Buyers will know what the exterior of the home looks like from the online posting and from arriving outside, as an estate agent, I know first-hand the importance of ‘kerb appeal’. And I can gauge the first impressions of prospective buyers the second they enter the house; some are more discreet (or polite!) than others but it doesn’t take long to figure out whether this is the home for them.

Once inside the front door, and this is true for most rooms they enter, viewers will instinctively head straight for the windows to check out the aspect of the room and, depending upon what they see, a certain impression is created. This is why rural homes are best seen in daylight and preferably sunshine – luckily for us, we operate out of the sunny South East so our homes have the edge.

So, knowing the importance of views to would-be buyers, it definitely makes sense to clean up the gardens, dispose of any rubbish or scrap metal and – depending upon the season – have a few planters positioned within the sight of the main windows. Of course, as we approach daffodil season, this task becomes much easier.

Sellers, I have posted before on the importance of giving your home a thorough cleaning and decluttering before bringing your home to the market, so let’s add touching up the garden to the ‘to do’ list. Also, knowing that intending buyers walk straight to the windows, please do ensure that window are sparkling clean, window stills are freshly dusted and decades-worth of ornaments are packed away, ready for moving to their new home. I understand that it is difficult for proud homeowners to accept this but house-hunters need as blank a canvas as possible so that they can imagine their own possessions and family pictures in each room.

Also, while we always stay with the house-hunter to ensure the security and privacy of our sellers, most will look into larger storage presses and under the stairs so avoid the temptation to pile stuff in there when tidying.

Other surprising facts that this research showed up include how viewers barely glance at floors and surfaces but tend to pay more attention to ceiling and cornicing so be sure to keep an eye out for any draping cobwebs.

Finally, a bit of good news for sellers who are scrubbing their property, getting ready to present it to the market, apparent none of the house-hunters opened the oven to check how clean it was!

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Local farmers with ‘spending power’ drive big prices for land in Wexford

Original article by Jim O’Brien, on Independent.ie

The last few weeks of 2016 saw somewhat of a flurry of sales in the auction rooms with good prices achieved, writes Jim O’Brien.

In the southeast, Alan Kinsella of Kinsella Estates Gorey and Carnew sold a 48ac non-residential farm at Ballybuckley, Bree near Enniscorthy in Co Wexford for €662,000 or €13,600/ac.

Located 800m from the village of Bree, the land is about 5km from Enniscorthy and across the road from the well-known Wilton House.

Currently in stubble, the holding is made up of two distinct lots consisting of a 16.15ac parcel with about 300m of road frontage and a 32.33ac parcel with laneway access.

The stubble ground is described by Mr Kinsella as good quality, south-facing land with access from two roads.

At auction, two rounds of bidding saw the amount on offer for the two lots reach a total of €465,000.

The 16.15ac piece opened at €160,000 and with two bidders in the chase, it was making €220,000. The 32.3ac parcel opened at €200,000 and with two bidders in action, it held at €245,000.

Bidding then concentrated on the entire in a sale driven by the two customers who had bid on lot two in the first round. When the amount on offer reached €580,000, Mr Kinsella consulted with the vendor and the property was put on the market at that price.

However, this was far from the end of the story and a further series of bids from three active customers saw the price break the €600,000 mark.

But still the hands kept rising until the hammer fell at €662,000 and a local farmer bought the place for €13,600/ac.

Enniscorthy auction

Staying in Wexford, Frank McGuinness and Michael O’Leary of Sherry FitzGerald O’Leary Kinsella sold a 92ac farm at Fairfield, The Still, Enniscorthy for €1.24m or €13,500/ac.

The holding, which includes a derelict house, has been idle for more than 10 years and will take some works to clear overgrowth and vegetation and bring it back to full farming production.

Auctioneer Frank McGuinness said that although the land is overgrown, it is fundamentally very good productive ground. The place has plenty of road frontage divided as it is by the Enniscorthy to Caim road.

Prior to auction, the property was guided at between €750,000 to €900,000 but on the day it exceeded all expectations.

Frank McGuinness was in charge of the gavel and opened proceedings with a 19ac lot across the road from the main farm. This opened at €150,000 and, with two customers in contention, was bid to €280,000.

The main lot – consisting of 73ac with the derelict house – attracted three interested parties and was bid to a hefty €820,000.

This gave a combined €1.1m for the entire, well ahead of the guide.

Mr McGuinness put the entire to the floor at €1.1m and with two bidders in action it quickly rose to €1.2m.

At this point, a new bidder entered the fray.

With four customers in action, the price rose quickly to €1.24m at which point the hammer fell and the place was bought by a solicitor based in Enniscorthy – believed to be acting for two clients.

Mr McGuinness said that while he was surprised at the price paid, the extension of the M11 to by-pass Enniscorthy and improvements to the New Ross road resulted in a lot of CPO land purchase in the area, hence farmers in the area have spending power.

Alan Kinsella agreed.

“The farmers who sold land for these developments have to spend it on land to avoid paying tax on it so there is more money for land in this vicinity at the moment,” he said.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

A Return to Rural Life

What will the Government’s rural action plan mean for sellers in South Wicklow and rural Wexford?

Last month, An Taoiseach, Enda Kenny launched the Government’s rural action plan ‘Realising our Rural Potential: The Action Plan for Rural Development’. This comes after a comprehensive action plan for housing and a longer term housing strategy looking forward Ireland in 2040. That’s a lot of plans! But what do all these plans actually mean, in real terms, if you are thinking of buying or selling a home or investment in rural Ireland over the next few years?

First things first, it has to be said that this is not just a Fine Fail/Fine Gael plan, it has the support of opposition members too, which should mean that it will live beyond the lifetime of the current government – in theory. From the input sought across a range of voluntary bodies and organisations, and the general public, there is clearly the intention to deliver real change for people living and working – or seeking work – in rural Ireland.

The ideas behind the plan are solid; there is a general recognition that there is a massive amount of potential locked away in rural areas. I see this myself in market towns across South Wicklow and County Wexford – there are highly skilled, motivated people who are unemployed or underemployed locally. Also, through my work, I meet people who want to return to their home towns but cannot do this until quality employment becomes available. And it’s not just down to employment; we have to look at the homes available, or the land that needs to be made available for development. I understand that many rural areas, particular in the West and Midlands, are plagued by ghost housing estates that no-one wants to live in, however, here in the Southeast; there is returning demand for available new homes. Local issues for us are more likely to be the derelict homes (with or without existing septic tanks on site) that buyers would be interested in if we could make them affordable and accessible.

The rural action plan aims to integrate existing frameworks of supports and to create new ones with the objective of increasing employment opportunities and access to public services in rural areas to increase the overall quality of life for people.

The plan involves co-ordinating and implementing a huge range of initiatives – there are 276 actions proposed – all to enhance the ‘economic and social fabric’ of rural Ireland. These initiatives focus on rural enterprise, tourism, culture, creativity and improving infrastructure and connectivity. It still sounds a bit vague, doesn’t it?

Here are the specifics:

- 135,000 new jobs to be created by 2020

- Increasing Foreign Direct Investment by 40% in regional areas

- Rejuvenation of 600 rural towns

- Pilot scheme to encourage town and village-centre living

- 12% targeted increase of rural tourism

- Acceleration of high-speed broadband in rural areas

- Protection of vital services (like GPs) in small towns

- 3,200 new Garda members and community CCTV

What this means for owners of vacant, boarded up commercial properties is that it might just be time to start taking the boarding down. With grants and schemes coming on-stream to support local enterprise, vacant retail and office units will be in demand once more. The Housing Department are currently looking at rolling out a rates alleviate scheme, which would be great for commercial landlords and tenants, but we do not yet have any details.

Of interest to owners of vacant – even derelict – residential properties, renovation grants are now available to restore properties in rural communities. This will attract home buyers, particular returning emigrants, back to their home towns. They can apply for a cash grant, not a tax rebate, of approximately €20,000 to purchase and renovate homes in villages and small towns. Uniquely, this scheme will be available to all home buyers, not just first-time buyers. It is particularly aimed at old people living alone in isolated areas, it is hoped that many will accept the benefit of this incentive and refurbish town and village-centre houses. This makes absolute sense for most people, allowing them to feel safer and more included within the everyday activities of the community.

Also, investors might be interested to learn of the Buy & Renewal Initiative, which allows local authorities and approved housing bodies to purchase buildings in need of refurbishment for the purpose of social housing. This will come as a timely opportunity for accidental investors, who might have inherited property but have been waiting to off-load it.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Dublin is ‘Eating’ Ireland: Wicklow & Weford Set to Benefit

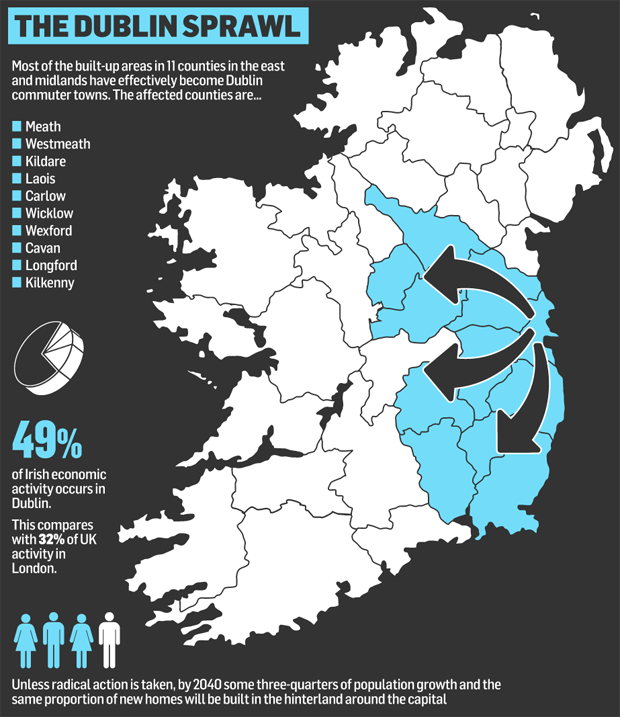

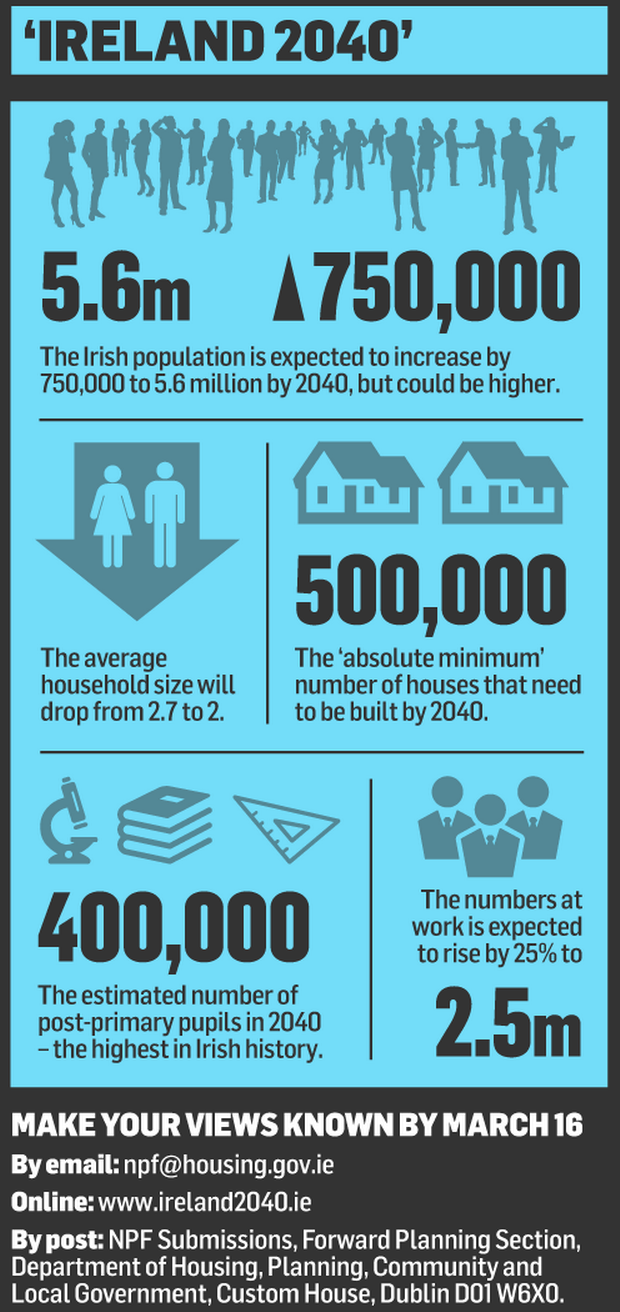

According to the Independent newspaper reporting of the recently released ‘Ireland 2040’ document, Dublin is “eating” the rest of the country

The report, launched by an Taoiseach and the Housing Minister last week, makes for tough reading for most of rural Ireland. It charts the gradual decline of rural businesses, communities, towns and villages. The simple reality is that when money leave an area, the people must surely follow. And this is exactly what happened. Today, close to half of all economic activity (49%) is generated in Dublin, which is pulling the labour force away from their home counties and closer to the capital. That figure is particularly worrying when you compare it to our closest neighbours; London generates only 32% of England’s economic activity.

We have been hearing about a two-tier country since the early days of the property crash and here in the South East, we know first-hand that recovery is not happening in a fair, uniform way. But this report forecasts where the population will be by 2040 if these trends continue, and it’s not good news for the majority of the country.

As we can see from the above image, all parts of counties Wicklow and Wexford are likely to benefit from this over the coming years and decades as the commuter-belt widens.

Over the past 20 years, half of the population growth in the entire State has been in and around the Dublin area. Without some big changes, this number is set to jump to 75% of population growth happening in that region by 2040. This is dire news for many but the South East is now looking more and more attractive, and not just for home buyers and investors. Businesses looking for a base outside of the capital, healthcare providers, education centres and other service providers are likely to come in this direction.

The work, development and investment cluster will not necessarily happen in Dublin. In fact, the report suggests that Dublin is or will become ‘the Dublin City Region’, extending into 10 other counties from Cavan to Wexford.

This report will impact hugely on our local planning over the next few years. As more commuters look south of Dublin and Wicklow, into Wexford, we must ensure that we have enough homes, hospital beds, school places and other necessary facilities for our growing population. For investors looking to buy strategically, Wexford offers particular value for money with ever-increasing potential for capital value appreciation.

Finally, there is a new State plan to save our rural towns and villages underway, this plan includes grants and incentives for buyers to restore derelict homes, and we’ll talk more about this next week.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Wicklow/Wexford Property Outlook for 2017

As recovery rolls out across the South East, we look at how the local market performed last year and what we can expect in 2017.

Last year saw the appointment of our new Housing Minister, Simon Coveney and his ambitious plan: ReBuilding Ireland. The unveiling and widespread acceptance of this plan was probably the highlight of the property year – along with a relaxing of the Central Bank mortgage deposit rules – but there were many, many lows. Without doubt, chronic lack of supply remains the critical issue and this is seen in the rising rental prices, record homelessness and a seeming stalemate within the developer community meaning that new supply remains well below demand for the third consecutive year. In particular, demand for housing in the capital increased by 10% while supply increased by a mere 1%.

Rentals prices increased nationwide by an average of 12% but Dublin and Cork saw increases of double that in key areas. An eleventh hour bill put forward by Minister Coveney – despite opposition from partners in government – aims to slow the rate of increase for the next three years to start with. Rent caps of 4% per year introduced for the Dublin area are likely to spread to other urban areas over the next few months, north Wicklow will be first in line for that but south Wicklow and Wexford are not expected to face rental caps this year (unless universal application, as called for by Fine Fail, makes its way into legislation).

As for the first time buyers’ help-to-buy tax rebate scheme, whether this is a high point or a low point, really depends upon who you listen to. The practical reality is that this initiative will only apply to a tiny proportion of buyers in today’s market. If the government really wanted to impact the market, they would not have taken such a scenic route to avoid the perception of helping the developers. The truth is that encouraging developers is exactly what is needed to get new housing units delivered as quickly as possible. This is something that the Minister has talked about and he has pledged to address the issue of building costs in the early part of 2017. One effective way to do this might be to help bring down building costs by reducing the VAT rate, even temporarily, as we saw in the hospitality sector. Unless building becomes commercially viable for developers and construction companies, there is no reason for them to take the risk.

But this needs to change.

From 2015 to the end of last year, the number of property purchases in Wicklow decreased from 1,402 to 1,271, mainly due to lack of supply rather than lack of demand, as evidenced by the price increases locally. A similar situation was seen in County Wexford where – despite price increases – the volume of transactions were down year-on-year from 1,663 to 1,471.

With the population in a state of increase, employment continuing its upwards trajectory and mortgage funding in more plentiful supply than we have seen over the past eight years, demand is surging. But without new housing, there is no way to service this demand. Until new supply hits the market, prices will increase as competing buyers pay a ‘scarcity premium’ for any available homes in the right areas.

At the moment, for buyers, there are currently fewer than 700 available properties in County Wicklow and just shy of 1,100 available in County Wexford, that’s between six to nine months worth of supply. New homes are needed to bridge the gap between supply and demand as a matter of urgency.

Click here to view all of our new and second-hand homes in Counties Wicklow and Wexford.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing.

Behind the Scenes: Kinsella Estates interviewed by Irish Property Developer Magazine

Last month, the team here at Kinsella Estates was nominated for the Littlewoods Ireland Blog Awards 2016 and we were delighted to be shortlisted! In fact, we are the first estate agency in Ireland to ever make the shortlist so huge thanks to the awards sponsors, organsers and everyone who voted. We see this as a signal of interest in property news locally and in the market generally so we are happy to share the information.

Shortly after this, we were asked by Irish Property Developer Magazine to give a behind the scenes look at how we market properties for clients in the digital era. You can read the interview here and feel free to let us know what you think:

Estate Agents: Behind the Scenes

This month Irish Property Developer met with Wicklow and Wexford-based estate agent, Michael Kinsella. Michael continues building the legacy auctioneering practice that his father founded almost five decades ago, together with family members and a team of staff from offices in Gorey and Carnew.

kinsellaestates.ie

- Are the traditional marketing methods e. for sale boards, newspaper advertising etc still relevant when marketing property for sale in today’s market ?

I am proud to say that our family has been serving the local community for over 50 years. Through that 50 years, we have witnessed a big change in the property business in general, and even our own business model. In the early days, for sale boards were the main marketing tool available. We would produce a property brochure in the office, containing the basic information about the property etc. In those days there was no such thing as BER rating’s etc and the information in the brochure was very basic. Buyers would also see properties listed in the window of the office on the main street. We would also place adverts for auctions and houses for sale in the local newspaper, which cost a lot of money back then and took a lot of time and effort.

While there is a perception that buyers only find properties online through property portal websites like Daft.ie or MyHome.ie, the truth is that the traditional ‘For Sale’ are still very effective as a selling tool. These boards have not changed much at all over the years. They are made of corrie-boards and wood. From an agent perspective, they are cost efficient and more importantly, very effective. In addition to attracting attention to the property for sale, they also help us maintain and promote our brand locally. We still use newspaper advertising but definitely not as much as in past times. Property for sale through auction will always be featured in local, and sometimes national, newspapers. We do run regular property adverts in the local paper for certain properties, many times this translates into some editorial coverage of the property in the local newspaper property features.

- How has digital/on-line marketing impacted on the company’s marketing communications strategy ?

We list all properties for sale on Myhome.ie and Daft.ie, and both have had a huge impact on our marketing strategy. While we are based in the South East, we get a huge amount of enquiries through the internet from people living in Dublin and Kildare etc. These sites give our company great reach to a much wider target audience. We have recently launched our brand new website; a huge amount of resources went into doing this well because, as local estate agency, we understand the importance of showcasing our clients’ properties and attracting buyers from outside of our locality. I studied property marketing as part of my Auctioneering Degree and I recognize how critical it is to not only have a website, but that it must be optimized for mobile use. I believe that we have to use the technology available to us, to continually improve our business. Standing still is not an option for any property business today. The marketing focus within the company continues to grow, whereas years ago marketing was just one of many functions that was carried out.

- Does the company have a mobile marketing strategy ? If so, why

is this important?

We do have a mobile marketing strategy. In fact, we have just launched our new website, which has been optimized for mobile usage as we recognise the growing trends away from PC and desktop use towards mobile. The web design company that built the website, 4PM (www.4pm.ie ), also use the latest search engine optimization tools available to ensure that we are always placed high up the search rankings. We have a number of features that we hope to roll out over the coming months, which I don’t want to reveal now, but these features will provide us with a website that will be right up to date in terms of the latest features available. It is important also that our clients know that we have beenhere for 50 years and hope to be here for another 50 years, and the only way we will do that is by continuing to office first-class service to our clients.

- (a)Which of the following on-line/mobile marketing tools does the company use ?

Mobile optimized website Yes Search Engine Optimization (SEO) Yes E mail marketing Occasionally Property portals Yes SMS Only with existing clients & buyers QR codes No Mobile Apps Yes YouTube video platform Yes Yes; Profile & Page Social media Yes Yes

We have a website optimized for mobile devices. We also use search engine optimization. We use the property portals. We use social media and e mail marketing. Our Social Media strategy really started to pay off last year, when we launched a blog on our website. All posts are circulated across our social media platforms. This boosted our likes/followers and fans; more importantly, increased engagement gave us the opportunity to showcase our expertise across the Wicklow and Wexford markets.

In fact, Kinsella Estates were the only Estate Agency in Ireland to be shortlisted for an award in the Littlewoods Ireland Blog Awards 2016. We were delighted to be shortlisted in the ultra-competitive ‘Lifestyle’ category.

(b) Any other ?

We do try all platforms to test and measure what works best, for us that’s the blog and our Facebook page but we are always interested in learning more!

- What are the most important marketing tools from the list above ? Why ?

The property portals are the most important, as I explained earlier. They provide a single market place, where we can list properties cost effectively. We know from experience how successful these sites are at delivering leads and enquiries.

Our website is also an important marketing tool, it also attracts a lot of visitors. It is part of our marketing strategy that it is updated daily, and that content is kept fresh. Research has shown that visitors to a site get frustrated when a site is not updated etc. While this takes time, effort and discipline it has to be done.

- What has been the biggest benefit that the on-line/digital/mobile technologies have brought to marketing residential property for sale ?

The quality of the information that we can present on a property. We can have beautiful digital photography, property videos can now also be uploaded. Brochures can be down loaded from the internet also. Our focus is definitely on video footage at the moment, for both the website and for our social media content.

- How has digital/on-line marketing impacted on relationship with vendors and customers ?

We put a huge amount of resources into marketing Kinsella Estates and marketing the properties we sell. A professional website puts us on an elevated platform with our clients and customers. It showcases our expertise, which gives our company a competitive edge in a very competitive market. Using social media allows us to reach a wider target audience and provides an opportunity to communicate with our customers. Our clients and customers are more knowledgeable nowadays, and they have a higher expectation of the service they want. We strive to meet and surpass their needs, and we are always keen to embrace marketing methods, customer relationship managements tools that enable us to deliver better service to our customers. We are committed to keeping up with technology and property trends; what’s good for our clients is good for the market.

The Structural Survey: Why it is important and what to expect

This week’s blog post is an extract of the Irish Property Buyers Handbook 2015, by Carol Tallon, dealing with the structural survey:

THE STRUCTURAL SURVEY

Why it is important and what to expect

The structural survey is a comprehensive inspection of the property in question, carried out by a qualified surveyor, registered architect or chartered engineer at the request of the potential home-buyer. It should not be confused with the lender’s survey, which in reality is merely an independent valuation report. The purpose of the structural survey is to give the purchaser an unbiased evaluation of the overall condition of a property, and to highlight any aspects that may need upgrading, repair, replacement or ongoing maintenance. Crucially, the report arising from the structural survey will provide the buyer with the information needed to make an informed decision on whether to go ahead with purchasing the property.

Unlike the bank survey, which is mandatory, a structural survey is optional, although any property professional would advise that the buyer undertake one before making the single, biggest investment of their life. Undertaking this due diligence and attaining the knowledge of defects or issues needing attention may discourage buyers from proceeding with the purchase outright, or may help to plan for work that is likely to be necessary in the short and medium term. Armed with this survey, the buyer should save a significant sum of money on defects that the seller may now have to correct before the sale is agreed. Knowing the cost of even small repairs, which can run to thousands of euro, can be a great negotiating tool. Aspects of the property that are routinely checked in the course of structural survey are as follows:

External Areas, Internal Areas, Other

- Roof and chimneys

- Guttering and flashing

- Settlement cracks

- Movement in foundations

- Windows and doors

- Drainage

- Boundaries

- Path and driveway

- Interior attic space

- Ceilings and floors

- Interior walls

- Windows and doors

- Heating system

- Plumbing and Electrics

- Working fireplaces

- Ventilation and damp

- Insulation

- Compliance with Building Regulations

- Boundary infringements

- Boundary conditions

There are some limitations to the survey, which may vary from one survey to another. Buyers will be made aware of these limitations by the surveyor, either in advance of the survey or within the report document. If there is any ambiguity, buyers are advised to seek clarification and not to assume anything. The most notable limitations tend to be as follows:

- Roofs and chimneys in excess of three metres generally will be examined from ground level.

- The building fabric will not be breached in the course of the inspection. The survey is strictly on the basis of what is visible or accessible.

- Plumbing and heating systems will be activated where connection permits, but will not generally be tested unless there is reason to suspect a problem.

- Sewers are inspected to the extent of lifting covers on manholes. Once again, testing will only be recommended where there is some reason to suspect something.

The age of the building to be surveyed is a very important consideration. Buyers should not be fooled by a modern, well-finished home. The age is no guarantee of a sound structure. In fact, many experts maintain that the overall quality of new home construction over the past decade has deteriorated somewhat. Older houses have their own particular issues to contend with – for example, non-regulation windows or access – but they are generally well-constructed. When looking at the structural condition of the property, the engineer will pay particular attention to defects that are inconsistent with the age of the property. The engineer will issue a full report to the buyer, which will set out areas of the property needing attention and make recommendations.

Defects or areas needing attention may cause a re-negotiation of the purchase price. In addition, defects that are inconsistent with the age of the house should flag concern. For example, if the engineer finds a hole in the roof of a modern, three bedroom semi-detached house, a question mark may arise over the quality of the property. On that point, some buyers in the past have chosen not to request a structural survey where the house in question is less than 10 years old and covered under the original structural defect insurance scheme, usually HomeBond. This is nonsense. Protection against defects for 10 years is of little benefit if the buyer cannot identify those defects.

It should be noted, however, that very few buildings are without any defects. The surveyor will furnish a lengthy report, many pages long, that will list observations, opinions and recommendations on issues that would not necessarily be classed as defects, so buyers should be prepared for this and not panic. When issues or possibly defects are identified, it does not necessarily mean that it is not a quality property. The buyer must work through the surveyor’s report and determine which issues are consistent and to be expected, which issues are easily remedied and which issues are essentially deal-breakers. Whatever the outcome, knowing in advance is essential – forewarned is always forearmed.

Engineers’ fees may vary, depending on the age and extent of the property, together with the location, or specifically, the time and travel involved. A survey generally will take between one to two hours. Buyers should expect to pay somewhere in the region of €300 to €450 plus VAT. If the buyer is waiting to sign contracts of sale, the engineer usually will give a verbal assessment of the property on the day of the survey – the equivalent to a thumbs up or thumbs down. The written report generally will issue within a period of five days. By engaging a suitably qualified surveyor with professional indemnity insurance, buyers are assured that they are covered in the event that they suffer financial loss as a result of neglect, error or omission in the course of producing the structural survey.

Snag List

A snag list will be necessary for buyers purchasing a newly-built home. It is not a structural survey, as discussed above, but rather a checklist of minor defects that the builder or developer must complete prior to the sale closing. The vast majority of newly-built properties are covered by a building guarantee or under a structural guarantee scheme, such as HomeBond or Premier, which protects the occupant of the home against specific significant defects for a period of 10 years. This protection applies to the property, not the owner; therefore, subsequent buyers will enjoy this protection for 10 years after the completion of the building.

The snag list consists of all the items that must be finished or fixed by the builder or developer before the sale is finalised. Builders have a poor reputation for after-sales service, so it is crucial that all outstanding items are dealt with before final monies are paid over. In certain circumstances, the sale might be allowed to proceed on the stated agreement of works to be carried out, but this leaves the buyer in a vulnerable position and is therefore not recommended. An exception to this might be the Irish weather causing huge delays in finishing the garden to specification. In this instance, the purchase might go ahead and close contracts subject to a small portion of the funds being withheld from the builder until such time as the garden works are completed.

As with the structural survey, a snag list is not mandatory, although it should definitely be regarded as essential by the new home-owners. Snag lists do not need to be carried out by a professional in order to be effective. In fact, some of the most comprehensive lists are carried out by the buyers, although engaging a professional engineer or surveyor has a number of benefits. Chiefly, their training and expertise suggests that they will uncover minor faults or needed finishing touches that the buyer might never have noticed. Secondly, they are likely to demand a higher quality finish than buyers might know to demand. Thirdly, buyers receive the benefit of professional indemnity insurance, as already discussed above. If any issue or defect is overlooked at the snagging stage, it may cost money to remedy it. By hiring a professional, that person is answerable to the buyer for any work carried out. Buyers who have some experience in construction or who have purchased property previously might feel confident about compiling a thorough snag list themselves. If so, there is now a wealth of information available through Irish and UK websites, where buyers can read tips, learn from other buyers and download comprehensive DIY snagging checklists. One good resource is www.snagging.org. If there is reason for concern, however, buyers should speak to a qualified engineer.

New Technologies

It is important to note, in the context of a survey or snaglist being prepared, that building, heating and electrical systems have become very complex with the introduction of renewable energy systems such as heat recovery units, ground source heat pumps and solar panel heating to name a few. It may be necessary to engage the services of a specialist to report on the conditions of such works in addition to the structural survey.

KEY POINTS FROM CHAPTER 17

- The structural survey is an inspection of the property in question, carried

out by a qualified surveyor for the potential home-buyer. - It is not to be confused with the lender’s survey, which is merely an independent valuation report.

- The purpose of the structural survey is to determine the condition of the property and to highlight any aspects that may need repair, replacement or ongoing maintenance.

- The structural survey will provide the buyer with the information needed to make an informed decision on whether to go ahead with purchasing the property.

- The buyer should be aware that older properties have inherent structural issues and these rarely will be considered deal-breakers. Buyers should be concerned about issues that are inconsistent with the age and price of the property.

- Further negotiations may take place to deal with issues arising from the report but only if they are inconsistent with the age and price of the property.

- A snag list consisting of all the items that must be finished or fixed by the builder or developer will be necessary for buyers purchasing a newly-built home.