Wexford House Price Increases Among Highest in Ireland

Key highlights from the latest Daft.ie property price report, October 2017:

- House prices are currently rising at a rate of €50 per day (no typo, that’s per DAY)

- Wicklow prices are up 9.9%, with an average house price of €315,994

- Wexford prices are up 11.4% – rising at a rate higher than most of the country – with an average house price of €195,480

- Stock shortage of all types of residential properties continue; unless new supply becomes available, prices will continue to rise

- Surprisingly, the increase seen between June and September this year was the smallest nationally since prices bottomed out in late 2013

- In the final nine months of 2016, approximately 15% of transactions related to newly built homes. In the first nine months of 2017, the rate is slightly higher at 17%

daft.ie House Price Report: Q3 2017 – An infographic by the team at daft.ie

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Ireland’s Residential Property Price Barometer (IPAV)

Earlier this week, the Institute of Professional Auctioneers & Valuers (IPAV) for Ireland published their ‘Residential Property Price Barometer’, which gives a breakdown of prices for two-bed apartments, three-bed semis and four-bed semis across every county in Ireland. According to this most recent research, the cost of an average family home in Dublin is now €527,894 – more than double that of the national average three-bed at €253,466. Wicklow remains the most expensive area outside of Dublin, followed by Kildare and Meath. Counties Longford, Sligo and Leitrim recorded the lowest house prices nationally.

The current average prices for County Wicklow and County Wexford are as follows:

On average, two-bed apartments in County Wicklow are coming in at €202,750, the highest apartment prices outside of Dublin by quite a significant margin. Three-bed semis are achieving an average of €275,591, while four-bed semis are making €344,036.

Similarly, across County Wexford, two-bed apartments are achieving an average sale price of €83,334, with three-bed semis making €145,000 and the four-beds getting, on average, €171,667.

The stand-out surprise is the unexpectedly strong performance of Wicklow apartments. Of course, we know that lack of available stock – in particular, houses – and delays with any new stock coming to the market is still the driving force behind the rising prices. Construction across the country, including the South East region, is nowhere near the level required at this stage. While the industry is set to deliver up to 20,000 homes per year by 2018 (which is up from just 12,666 in 2015), this is not happening quickly enough to meet current or immediate demand within the commute region.

As we watch for the delivery of new homes, it is worth reflecting on changing buyer trends in recent years. For example, here at Kinsella Estates, we can see that house-hunters have never been more organised, better researched or as familiar with the market as this current generation of buyers are. They are knowledgeable and well-informed, however, their expectations of quality and energy efficiency are much higher than their predecessors and developers need to be mindful of this.

With such a dearth of new homes available, particularly here in South Wicklow and North Wexford, it makes sense for home buyers – whether they are looking for their first home, trading up or perhaps downsizing by the coast – to consider purchasing a second-hand home.

Traditionally, September has always been the height of the selling season. Over the past decade, the market has definitely become less seasonal and more opportunistic. The reality is that homes coming to the market locally are being presented to known buyers. Through our offices in Carnew and in Gorey, we know buyers who have been looking for the last few months and when we visit a home to appraise it for sale, very often, we have a good idea of who the buyer is likely to be. This can help speed up the sale process, which is good news for the seller, but more importantly, by knowing the buyer, their budget and their capacity to close the deal, we can add a greater degree of certainty at a time when sellers need it most.

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

The Flip Side of Ireland’s Rental Crisis

There is no crisis without opportunity; sometimes it can be difficult for most people to spot the opportunity but you can be sure that it exists, hidden from plain sight, just waiting to be exploited by the right person.

In fact, the ancient Greek word ‘crisis‘ also translates into ‘opportunity’.

We saw this in the Irish property market back in 2011/2012, when foreign funds and investors started to buy up chunks of undeveloped land nationwide or entire blocks of unfinished apartments. Our crisis opened up an opportunity for cash-rich investors who were willing to take a risk that things would improve which, of course, they did – eventually.

So, looking at the marketplace today, savvy investors will no doubt be trying to spot the hidden opportunities in our most recent crisis – our private rental sector. Earlier this week, on foot of the latest Daft.ie report on the sector, news headlines screamed that we now have fewer available rental properties in Ireland than ever before in recorded history. And this is not just a Dublin problem, this is happening right across the country. Here in the South East, quality rentals, particularly houses, are at an all-time low.

We know that the answer is to build more houses and apartments, we know that developers are trying to do just that, but here is the situation – even if developers’ funding and planning permissions are in place, it is still going to take 18 to 24 months to see any significant delivery. In reality, it is probably going to be three to four years or more before we see completed developments released to the market in South Wicklow and North Wexford in any real scale. This means that we are not likely to see much relief to the rental market crisis for some time yet.

If this crisis is set to continue, and it certainly looks that way for the moment, then we need investors looking to the opportunities hidden within the crisis. We need private landlords back in the market, despite them being hit with burdensome taxes and compliance issues, we need more accommodation right now than the State can reasonably provide.

One positive step forward is the reclamation of mortgage interest paid by landlords as a legitimate expense – this is happening slowly over successive annual budgets but at least it is happening.

While increased taxes, reduced tax reliefs, onerous RTB and legislation compliance – not to mention rising property prices and low available stock – all make one-off residential investment much less attractive than it might have been a decade ago, we know that rental returns are exceptionally strong at the moment is this is set to continue for the next few years.

Here at Kinsella Estates, we understand that investor finance is more difficult to come by and certainly, margins are much tighter than ever before; however, we also know that affordable houses and apartments can yield annual returns of up to 10%. For a cash investor, we know that this makes sense.

At the moment we are listing a few of the last remaining homes in County Wicklow for under €100,000. While some need some upgrading work, others are ready-to-go, high-yielding investments.

For example, one of our superb houses in South Wickow, 25 Coollattin Road, Carnew offers unbelievable value at €99,000 for a spacious, four-bedroom house and garden within walking distance of the town, local school and shops.

25 Coollattin Road, Carnew, County Wicklow:

If you are considering selling in the South Wicklow and North Wexford areas, call into one of our offices (located in Carnew and Gorey) and chat to any of our expert team or you can contact us online at kinsellaestates.ie. We are happy to facilitate overseas buyers and sellers via Skype or similar, outside of regular office hours.

Alternatively, email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Checklist for property sellers

Checklist for Property Sellers

Selling your home (or investment property) can seem overwhelming when you first start thinking about it. As second-generation estate agents, we genuinely understand that a lot of work goes into researching and actually making the decision to sell before you even consider embarking on the sales process. So, with that in mind, we wanted to make life a bit easier for prospective sellers by preparing a handy checklist – be sure to add your own and to let us know anything else that ought to be included on this list:

- Is selling the right decision for you?

So often, this very important first step gets overlooked as being obvious but for many people, it is not obvious at all. Irish people tend to move home less often than our UK neighbours (not counting the dreaded student and early career rentals!) so, in our experience, it is something that families think about for a year or perhaps even two years before they actually bring their homes to the market. And we understand that. It is a huge decision for people to make for their families, whether their children are young or whether they have left the family home for college or to start their careers elsewhere, the family home is still considered the family home. The decision is about more than finances and convenience or even suitability, there is an emotional component that makes it difficult to reach a decision. At Kinsella Estates, we get to know our sellers and try our best to understand the emotional elements as well as the practical aspects like whether this is a good time to sell the type and value of property that you own. We see our job at this stage as providing the right market and financial information so that you, the seller, can make the right personal decision.

- Check local property prices via the property price register

Once you have made the decision to sell, it is important to get a sense of local values. Local properties listings are helpful, as it the national property price register – which is publically accessible. Please bear in mind that this register can be a few months behind as the conveyancing process usually takes a few months from going sale-agreed to actually closing the contracts and handing over keys so get up-to-date market information from your local agent.

- Get valuation and local insights – supply vs. demand

The next step is to get a valuation on your property, at Kinsella Estates, this is a complimentary service we offer to property owners. This valuation is important, but of more importance, is to find out about local supply and demand levels. This just one of the ways that local estate agents bring their expertise to the sales process. Market valuation is one thing, but you need to know what other properties on the market your home will be competing with. Also, you need to know what level of demand exists – roughly how many buyers are currently looking for a property, similar to yours, and have the right budget to purchase? This level of detail will greatly help a seller by setting very realistic expectations of the market and how well the property is likely to sell.

- Get your legal documentation in order and instruct your solicitor

Once you are happy with the valuation and ready to kick off the sales process, we always recommend instructing your family solicitor. Once instructed, your solicitor will ‘take up’ the title deeds and supporting documentation from your bank. Or, if there is no mortgage on the property, your solicitor will draft the contracts for sale so that they are ready to issue as soon as the property is sale-agreed. By taking this step early, it eliminates potential delays and gives your solicitor an opportunity to request further documentation from you , for example, receipts of property tax or NPPR tax.

- BER

Most homes that have now been bought or sold in the last decade are unlikely to have a Building Energy Rating or BER certificate. This is a mandatory certificate that every property being sold or leased must have and provide to the buyer or tenant. At Kinsella Estates, we can organise that for you quickly and at an inspection time that suits you.

- Preparing the property exterior

The next step is to prepare for the marketing photographs and content for your brochures and online listings. In this increasingly busy – and digital – age, it is crucial to have great photos (which we appreciate can be difficult in Irish weather, but luckily we work in the sunny south east so we have an advantage!). If it is possible to spruce up the exterior and give it a paint job then we definitely recommend that, if not, clear away as much as possible and give the front door a fresh coat of paint and perhaps a seasonal planter outside.

- Preparing the interior for photos

We talk about preparing for viewings with buyers in another post but for today, it’s all about preparing for photographs. The golden rule is to maximise light and space and to minimise ‘stuff’ or clutter. Prospective buyers need to see your home presented in the best possible way and they want to see as many photographs as possible. Remember, you are unlikely to sell your home to someone who doesn’t view it (with the exception of remote buyers via 3D tours, which we now offer) so the job of the brochure and online listing is to showcase your home to its best so that house-hunters will want to visit.

Kinsella Estates are on-hand to offer helpful and practical advice at every stage of the selling process. We understand the importance of bringing your home to the market in a way it deserves, and we know how to attract attention from the right buyers to maximise the value and potential of your property. Talk to us about your individual property and let us help you create the best first impression for your home.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie .

Email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

House Prices: What We Can Expect for 2016

Property Update for Wicklow & Wexford

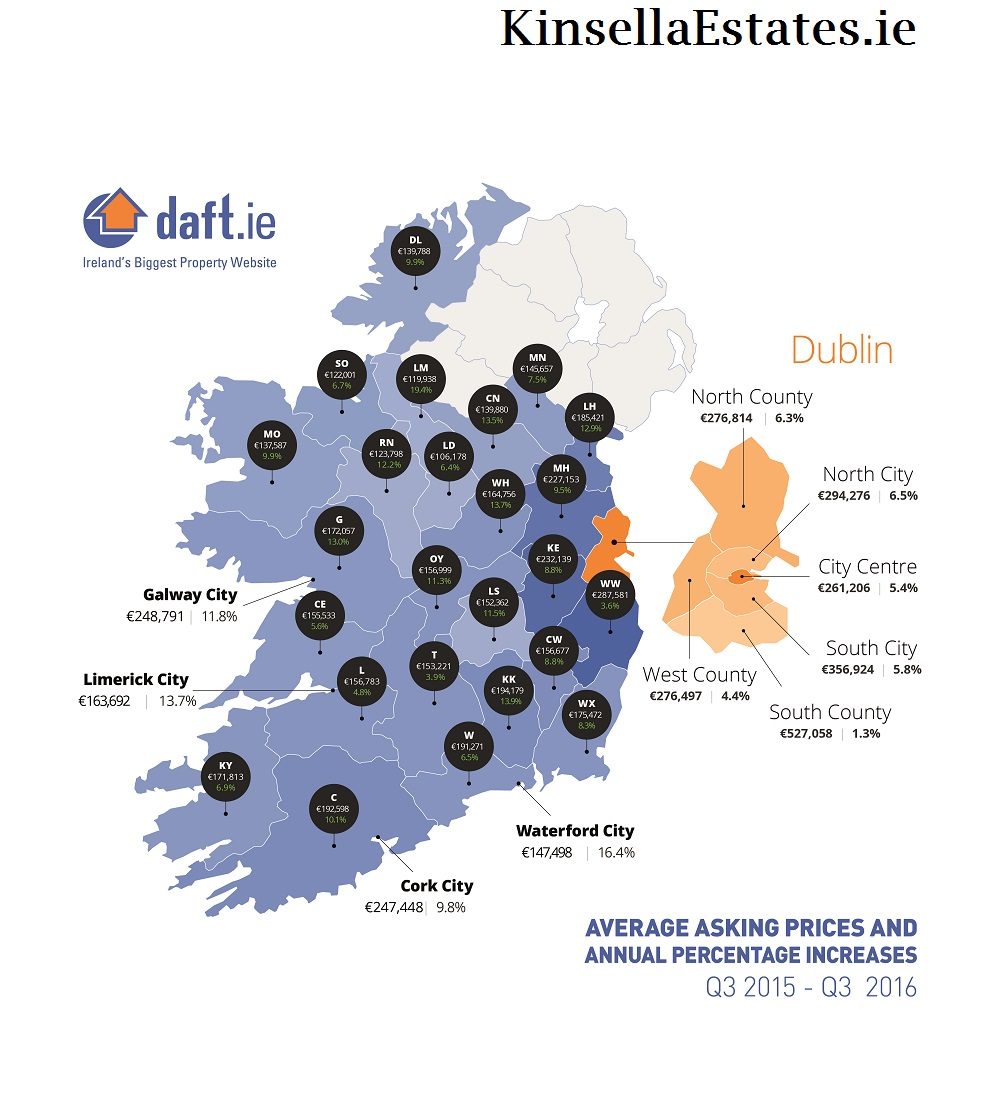

According to the most recent Daft.ie House Price Report, prices nationally rose close to 3% between June and September.

County Wicklow remains the fourth most expensive area for buyers but this does not allow for the huge discrepancy in prices between the north and the south of the county.

The average house price in Wicklow is now €287,581, an increase of 3.6% year on year. Interestingly, the rate of increase in County Wicklow is one of the slowest in the country, although this is likely explained by the early rapid increases experienced in the area.

Looking the Wexford market, house prices have increased by 8.3% year-on-year. The average house price in Wexford is now €175,472.

For home-buyers trading up and down, there are just over 400 houses for sale across County Wicklow with a price tag under €500,000, where as in Wexford, that figure jumps to over 800 houses. The great thing for first-time buyers is over half of those houses in Wexford are available below €200,000, whereas less than a quarter of the available houses in County Wicklow carry that price tag. This is why first-time buyers are back looking at the South Wicklow and Wexford area for their house-hunting.

This will also be of interest to cash investors looking to buy a house (usually in need to upgrading) for under €100,000. While less than 20 such properties are currently available in County Wicklow, investors will have approximately 100 budget houses to select from in neighbouring County Wexford.

When you look at the rental figures, the above pricing makes great sense for investors. Rental demand in consistently strong across both counties, while lease prices in North Wicklow can reach double the levels of those in rural area across the south of the county. The national average rent price has risen by over one third since bottoming out in 2011 and is now at its highest level since records began. In most areas, monthly rents are now almost 10% higher than they were just one year ago. This is bad news for tenants but good news for investors.

The improved road infrastructure has played a huge part in attracting commuters from the capital but the affordability, increased space and quality of family life have been the main drivers in our experience.

The forecast from Daft.ie:

“This situation in the general market is not going to change over the next few weeks.”

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact myself (Michael), Alan or Eileen Kinsella at kinsellaestates.ie or email me directly on michae