The property report we’ve been waiting for

Every few months, the team here at Kinsella Estates bring you the round up of property statistics and trends from the previous quarter but this week we have even bigger news. The Central Statistics Office , or CSO, have released a special housing report, based on the latest census figures. This is a big deal as it offers an insight into the market and key measurements that we only get once every five years and for those who have been watching the market over the last five years, you will know that there have been lots of changes – good and bad. This is the first such report since the market started to recover in 2012 and it definitely going to cause a bit of trouble as it contradicts new housing supply numbers released earlier this year by the Department of Housing.

The report covers total housing stock levels, new builds completed and the changing patterns of renting, for example, the trend towards older people renting rather than owning their own home. One Irish Times journalist described it as “a picture of everything we wanted to know about the Irish housing crisis but were too afraid to ask”.

Looking at the 12 months up to March this year, we can see that the overall residential market is up almost 11%. Broken down, this translates into increases in the capital of just over 8% while areas – particularly in the west of the country, which was well behind the recovery we have seen here in the south east – have seen house price growth of up to 20% in the last year. In general, the property market in Ireland is still about 30% below peak levels last seen in 2007.

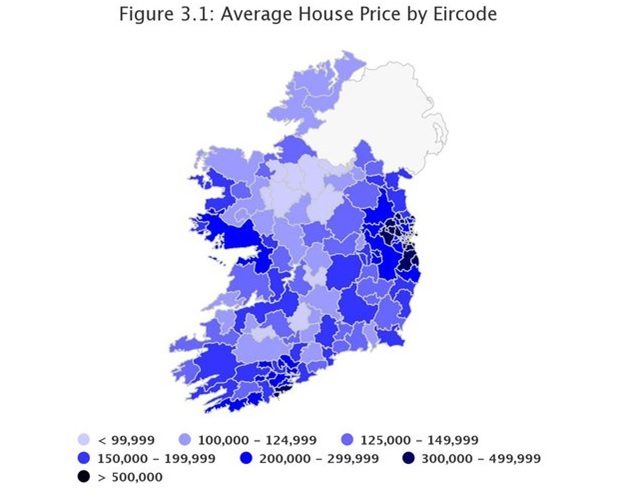

In terms of volume, the total number of homes purchased over the last year (February 2016 to February 2017) is 37,294. What is interesting to note is the breakdown by buyer type; only a quarter of all buyers were first-time buyers and less than a quarter were investors or non owner-occupiers. This means that homebuyers trading up and down, and those buying holiday homes, represent the driving force within the market. People might be surprised to learn that the average home price in Dublin is now €398,319 and it is difficult to believe that that could have been achieved without the relaxing of the Central Bank lending rules last year and the introduction of the controversial Help-to-Buy scheme. The average price paid for a home nationwide is currently €245,165. In County Wicklow, house prices are the highest outside of Dublin, with an average sale price achieved of €313,023. Take a look at the image above (figure 3.1) for an indication of where real progress has been felt and where the recovery has effectively bypassed.

Outlook

While it is not good news for house-hunters, property prices are set to increase by double digits again this year. In fact, Davy Stockbrokers said that 10% is a conservative estimate of future growth this year and the real figure might be much higher. This will come as a great relief to sellers and homeowners currently caught in the negative equity trap but it raises the ugly question: Is double digit growth sustainable without significant development and can buyers truly depend on new supply coming into the market? Unfortunately, there is no single answer to this but as the new homes specialists in counties Wicklow and Wexford, Kinsella Estates are in a good position to help would-be buyers identify new developments coming up locally over the next 18-24 months.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Local farmers with ‘spending power’ drive big prices for land in Wexford

Original article by Jim O’Brien, on Independent.ie

The last few weeks of 2016 saw somewhat of a flurry of sales in the auction rooms with good prices achieved, writes Jim O’Brien.

In the southeast, Alan Kinsella of Kinsella Estates Gorey and Carnew sold a 48ac non-residential farm at Ballybuckley, Bree near Enniscorthy in Co Wexford for €662,000 or €13,600/ac.

Located 800m from the village of Bree, the land is about 5km from Enniscorthy and across the road from the well-known Wilton House.

Currently in stubble, the holding is made up of two distinct lots consisting of a 16.15ac parcel with about 300m of road frontage and a 32.33ac parcel with laneway access.

The stubble ground is described by Mr Kinsella as good quality, south-facing land with access from two roads.

At auction, two rounds of bidding saw the amount on offer for the two lots reach a total of €465,000.

The 16.15ac piece opened at €160,000 and with two bidders in the chase, it was making €220,000. The 32.3ac parcel opened at €200,000 and with two bidders in action, it held at €245,000.

Bidding then concentrated on the entire in a sale driven by the two customers who had bid on lot two in the first round. When the amount on offer reached €580,000, Mr Kinsella consulted with the vendor and the property was put on the market at that price.

However, this was far from the end of the story and a further series of bids from three active customers saw the price break the €600,000 mark.

But still the hands kept rising until the hammer fell at €662,000 and a local farmer bought the place for €13,600/ac.

Enniscorthy auction

Staying in Wexford, Frank McGuinness and Michael O’Leary of Sherry FitzGerald O’Leary Kinsella sold a 92ac farm at Fairfield, The Still, Enniscorthy for €1.24m or €13,500/ac.

The holding, which includes a derelict house, has been idle for more than 10 years and will take some works to clear overgrowth and vegetation and bring it back to full farming production.

Auctioneer Frank McGuinness said that although the land is overgrown, it is fundamentally very good productive ground. The place has plenty of road frontage divided as it is by the Enniscorthy to Caim road.

Prior to auction, the property was guided at between €750,000 to €900,000 but on the day it exceeded all expectations.

Frank McGuinness was in charge of the gavel and opened proceedings with a 19ac lot across the road from the main farm. This opened at €150,000 and, with two customers in contention, was bid to €280,000.

The main lot – consisting of 73ac with the derelict house – attracted three interested parties and was bid to a hefty €820,000.

This gave a combined €1.1m for the entire, well ahead of the guide.

Mr McGuinness put the entire to the floor at €1.1m and with two bidders in action it quickly rose to €1.2m.

At this point, a new bidder entered the fray.

With four customers in action, the price rose quickly to €1.24m at which point the hammer fell and the place was bought by a solicitor based in Enniscorthy – believed to be acting for two clients.

Mr McGuinness said that while he was surprised at the price paid, the extension of the M11 to by-pass Enniscorthy and improvements to the New Ross road resulted in a lot of CPO land purchase in the area, hence farmers in the area have spending power.

Alan Kinsella agreed.

“The farmers who sold land for these developments have to spend it on land to avoid paying tax on it so there is more money for land in this vicinity at the moment,” he said.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Your Guide to the Help-to-Buy Scheme

Budget 2017 announced the Help-to-Buy scheme, which has proven controversial within the industry, to help intending first-time buyers to put together the deposit required to purchase or self-build their new house or apartment.

The scheme works by way of an income tax and DIRT tax refund, in respect of payments made over the previous four tax years. There are three types of applicants who can apply for the Help-to-Buy scheme, namely: retrospective applicants or buyers whose contracts are signed between 19 July 2016 and 31 December 2016; first-time buyers whose contracts are signed between 1 January 2017 and 31 December 2019; and first-time self-build applicants building between 1 January 2017 and 31 December 2019.

Eligibility:

- The buyer must be a first-time buyer, specifically, the buyer must not have either individually or jointly with any other person (directly or indirectly), previously purchased, or built a property. Where more than one individual is involved in purchasing or building a new home, all of the individuals must be first-time buyers.

- The house or apartment must be a new-build (may be self-built)

- The purchase must be dated between 19 July 2016 and 31 December 2019

- The property must have been purchased or built as the first-time buyer’s home and not acquired for investment purposes.

- The property must be occupied by the first-time buyer, or at least one of the first-time buyers in the case of multiple first-time buyers (a group), for a period of five years.

How to apply:

- Registered for myAccount (PAYE) or ROS (self-assessed)

- PAYE taxpayers will need to complete Forms 12 (available through ROS) for the tax years selected for refund

- Self-assessed taxpayer will need to complete Forms 11 (available through ROS) for each of the four years immediately prior to the claim. Please not that any outstanding taxes must be paid.

In order to apply for the scheme/refund, buyers must enter the following information online:

- Property details including address and price

- Details of each first-time buyer and refund agreed

- Developer/Contractor details or

- Details of the Solicitor if self-building

- Upload a copy of the signed

- Balance of the deposit to be paid

- Contract completion date

- Mortgage details

- For self-builders, proof of drawdown of the first mortgage tranche payment

All details must be verified by the Developer/Contractor in the case of a new build, or by the purchaser’s Solicitor in the case of a self-build, before the refund can be paid out.

For further details on the scheme, contact the Office of the Revenue Commissioners

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing on our qualifying new builds.

Wicklow/Wexford Property Outlook for 2017

As recovery rolls out across the South East, we look at how the local market performed last year and what we can expect in 2017.

Last year saw the appointment of our new Housing Minister, Simon Coveney and his ambitious plan: ReBuilding Ireland. The unveiling and widespread acceptance of this plan was probably the highlight of the property year – along with a relaxing of the Central Bank mortgage deposit rules – but there were many, many lows. Without doubt, chronic lack of supply remains the critical issue and this is seen in the rising rental prices, record homelessness and a seeming stalemate within the developer community meaning that new supply remains well below demand for the third consecutive year. In particular, demand for housing in the capital increased by 10% while supply increased by a mere 1%.

Rentals prices increased nationwide by an average of 12% but Dublin and Cork saw increases of double that in key areas. An eleventh hour bill put forward by Minister Coveney – despite opposition from partners in government – aims to slow the rate of increase for the next three years to start with. Rent caps of 4% per year introduced for the Dublin area are likely to spread to other urban areas over the next few months, north Wicklow will be first in line for that but south Wicklow and Wexford are not expected to face rental caps this year (unless universal application, as called for by Fine Fail, makes its way into legislation).

As for the first time buyers’ help-to-buy tax rebate scheme, whether this is a high point or a low point, really depends upon who you listen to. The practical reality is that this initiative will only apply to a tiny proportion of buyers in today’s market. If the government really wanted to impact the market, they would not have taken such a scenic route to avoid the perception of helping the developers. The truth is that encouraging developers is exactly what is needed to get new housing units delivered as quickly as possible. This is something that the Minister has talked about and he has pledged to address the issue of building costs in the early part of 2017. One effective way to do this might be to help bring down building costs by reducing the VAT rate, even temporarily, as we saw in the hospitality sector. Unless building becomes commercially viable for developers and construction companies, there is no reason for them to take the risk.

But this needs to change.

From 2015 to the end of last year, the number of property purchases in Wicklow decreased from 1,402 to 1,271, mainly due to lack of supply rather than lack of demand, as evidenced by the price increases locally. A similar situation was seen in County Wexford where – despite price increases – the volume of transactions were down year-on-year from 1,663 to 1,471.

With the population in a state of increase, employment continuing its upwards trajectory and mortgage funding in more plentiful supply than we have seen over the past eight years, demand is surging. But without new housing, there is no way to service this demand. Until new supply hits the market, prices will increase as competing buyers pay a ‘scarcity premium’ for any available homes in the right areas.

At the moment, for buyers, there are currently fewer than 700 available properties in County Wicklow and just shy of 1,100 available in County Wexford, that’s between six to nine months worth of supply. New homes are needed to bridge the gap between supply and demand as a matter of urgency.

Click here to view all of our new and second-hand homes in Counties Wicklow and Wexford.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact Michael, Alan or Eileen Kinsella at kinsellaestates.ie . Alternatively, you can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718 to arrange a viewing.

Helping buyers get their dream homes

Here at Kinsella Estates we love what we do and the best part of our day is when we hand new buyers the keys to their dream home!

“Thank you for all work in getting us the keys to our new home.

Michael was very professional and always went above and beyond for us always

The staff in the office were brilliant and always got back to us.

We would highly recommend Kinsella Estates to anyone buying a new or second home.”

Tips For Selling Your Rural Home

Over the last few years we got to learn a lot more about the property market than ever before. We have websites like Daft.ie listing most properties for sale around the country together with the asking prices, we have the National Property Price Register telling us achieved sales prices and, most recently, the CSO has started including cash purchases rather than just reporting on mortgaged property transactions. All of this is helpful, it improves transparency in the marketplace and that’s good for everyone, not just buyers and sellers but us agents too! The only problem is that most of the statistics are coming from the sale of town houses and apartments. It is much more difficult for rural homeowners to gauge the value of their home and particularly if their home has lands adjoining. For rural homeowners thinking of selling, definitely talk to us and we can let you know about recent sales, achieved prices locally and current ready buyers in the market.

For rural properties, often times, there are fewer interested buyers but this is not necessarily a bad thing. It can mean less time wasting as only very interested parties tend to view. Of course, this also means that it is crucial to get the listing, marketing and presentation right from the start. It’s a cliché that there is only one opportunity to make a first impression but it’s also true. A disappointed house-hunter will rarely re-visit or re-consider a property that they have already ruled out just with the promise of a clean-up or painting job.

When I or any of the team here at Kinsella Estates visit a home (before listing it for sale) we will always give feedback on the current presentation and give advice on any changes or cost-effective improvements that are likely to either increase the value of the home or increase the attractiveness of the property to buyers.

When it comes to doing this suggested work, we can always advise on what repairs or maintenance are necessary or those that will generate a return. It is not about renovating your home prior to sale, this is unlikely to ever make financial sense for homeowners.

Ways to prepare your rural home for sale is to put together area and property maps, good quality photos if you have them although we will always take professional quality images for the sales brochure, and definitely compile a list of contents included in the sale. We will always position a rural property by giving driving distances to the next largest towns, as this helps potential buyers who might be unfamiliar with the vicinity to decide if the location works for them. As part of our online listings, Kinsella Estates will accurately pinpoint your location on Google Street View (an interactive satellite map) so that interested buyers can find your property, also, they can get a sense of where it is in relation to neighbouring towns.

In my experience, including proximity to local schools, clubs and other facilities is helpful. We understand that no-one knows the property as well as the owner so we will listen to what you have to tell us and then package that information for interested viewers.

While it might sound a bit unusual, I advise sellers to put together the most recent utility bills, bin collection information and any other relevant information that a prospective buyer would need to know about the running of the property. In recent years, buyers are aware of new septic tank regulations and will certainly be looking for evidence of compliance as standard. Internally, a clutter-free environment is the most important thing. Neutral decor is generally a safe bet, buyers don’t mind an older or dated property provided they can see the potential and the best way to show people potential it to empty it as much as possible. The practice of clearing your home prior to sale is not just good for presentation, it is also a great way to get a head start on moving!

Do not underestimate the power of curb appeal; in truth, the first impression is made as the house-hunters turn into your laneway or drive. With that in mind, keep hedges trimmed, mow lawns and most importantly, remove junk from around the house and sheds. Potted plants can brighten up any yard so this is an easy way to improve the overall impression. Also, give the entrance pillars a coat of paint, remove weeds and make the drive accessible for multiple cars, if possible.

Even animal lovers will panic of they are greeted by a pack of barking dogs upon arrival; please ensure that all pets are under control during viewing times. Similarly, if you have animals in paddocks around the home, do let us know about any special precautions needed when showing people around.

Finally, because rural homes are unique, please do understand that interested buyers are likely to have lots of questions, they will want the view the property more than once and will probably take a bit longer to make a decision. Remember this is all leading to you finding the right buyer (or letting the right buyer find you and your home!).

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact myself (Michael), Alan or Eileen Kinsella at kinsellaestates.ie .

You can email me directly on michael@kinsellaestates.ie or telephone : +353 53 94 21718

Budget 2017 for Property Buyers and Sellers

Property Measures Announced in the Budget

We knew in advance of Budget ’17 that housing was going to be a priority so Michael Noonan’s budget speech contained very few surprises, if any, for the sector.

In an earlier post, I detailed the Government’s Action Plan for Housing: Rebuilding Ireland. This plan sets out the housing problems to be tackled and steps that will be taken. While the issues are broken up into five categories or ‘pillars’ they all come back to one common underlying problem, that is, the chronic lack of supply across all housing sectors from social to private to rental. Developers and members of the construction industry have blamed the cost of building and budgetary measures were definitely needed to address this. Unfortunately, this is not what we got on Budget Day. Instead, we got a grant – by way of tax rebate – for first-time buyers purchasing newly built homes only.

In an earlier post, I detailed the Government’s Action Plan for Housing: Rebuilding Ireland. This plan sets out the housing problems to be tackled and steps that will be taken. While the issues are broken up into five categories or ‘pillars’ they all come back to one common underlying problem, that is, the chronic lack of supply across all housing sectors from social to private to rental. Developers and members of the construction industry have blamed the cost of building and budgetary measures were definitely needed to address this. Unfortunately, this is not what we got on Budget Day. Instead, we got a grant – by way of tax rebate – for first-time buyers purchasing newly built homes only.

This help-to-buy scheme for first-time buyers will give a rebate of income tax (already paid) of 5 per cent of the purchase value of a newly-built home, up to a value of €400,000. That translates to a maximum rebate of €20,000 in cash. Properties costing from €400,000 to €600,000 will qualify for the €20,000 rebate, but the scheme will not apply to homes over €600,000 in value. This is a temporary measure only, backdating to July 19th last and will run until the end of 2019. In practical terms, buyers of a new house costing €300,000 will qualify for a rebate worth €15,000, however, they will still need their €23,000 deposit (under the Central Bank rules) and they must have a combined income of €75,000.

While the rebate is designed to offset the cost of higher deposits required from first-time buyers, and in turn boost demand, it has been perceived by members of the sector as a grant to the developer. Irrespective of the designed purpose, in real terms, this is the least effective way to stimulate supply and is likely to simply increase prices for first-time buyers already struggling to afford their first home.

While the first-time buyer initiative has been deeply criticised across the industry, at least there was some attempt to address their concerns. Those stuck in rental situations were not so lucky. At best, the help-to-buy scheme will create get a small portion on renters out of this market and into their own homes, and this should free up some rented accommodation.

Other Property Measures

Other Property Measures

- Residential investors/landlords received a 5 per cent increase in their mortgage interest relief, from 75 per cent to 80 per cent in 2017 and this is expected to increase annually until it reaches 100 per cent again.

- The Home Renovation Incentive Scheme was extended further by two years, bringing it up to the end of 2018.

- The Rent a Room scheme had its tax-free income ceiling here has increased by €2,000 annually to bring it up to €14,000.

For specific queries or to speak with a local property expert about your buying and selling needs in Wexford, Wicklow and surrounding areas, contact myself (Michael), Alan or Eileen Kinsella at kinsellaestates.ie or email me directly on michael@kinsellaestates.ie and telephone: +353 53 94 21718

From the Horse’s Mouth: Housing in Budget 17

Coveney announces transformational housing budget

- 50% increase in housing budget for 2017

- Housing needs of over 21,000 being met in 2017

- Funding for 3,000 exits from emergency accommodation in 2017

- New First Time Buyers initiative – 5% of purchase price, max €20k

The Minister for Housing, Planning, Community and Local Government, Mr. Simon Coveney,T.D., today (11 October 2016) welcomed significant additional funding allocated for 2017 to underpin Rebuilding Ireland the Government’s Action Plan for Housing and Homelessness. In Budget 2017, the Government is allocating €1.2 billion to housing programmes, a 50% increase over 2016. Thi

The Minister for Housing, Planning, Community and Local Government, Mr. Simon Coveney,T.D., today (11 October 2016) welcomed significant additional funding allocated for 2017 to underpin Rebuilding Ireland the Government’s Action Plan for Housing and Homelessness. In Budget 2017, the Government is allocating €1.2 billion to housing programmes, a 50% increase over 2016. Thi

s investment will see the housing needs of over 21,000 households being met in 2017. In addition, local authorities will fund a range of housing services to the value of €92 million from surplus Local Property Tax receipts, bringing the total housing provision in 2017 to almost €1.3 billion.

Speaking after Budget 2017 was announced, Minister Coveney said:

“What I am announcing today represents a transformational budget for housing in Ireland. I said at the launch of Rebuilding Ireland in July that meeting the housing challenge is the key priority for this Government. The package of measures I am announcing with Cabinet colleagues demonstrates the extent of that commitment. The investment provided by the Exchequer and by local authorities will allow us to meet the housing needs of 21,050 families in 2017. As part of this, I am providing an increase of €28m in funding for homeless services, underscoring the particular priority I attach to this issue, including the provision of emergency supports for rough sleepers and ending reliance on the use of hotels for homeless families by mid-2017.

The Budget also contains a comprehensive package of supports for the wider housing market in terms of a significant tax rebate for first time buyers to stimulate the supply of new homes; extension of mortgage interest relief for existing homeowners; and changes to Capital Acquisitions tax The rented sector is a key focus under Rebuilding Ireland and in this Budget we have introduced a number of important supply incentives including improvement in mortgage interest relief for landlords, increase in the ceiling for the rent-a-room scheme, extension of the Living City initiative to rental properties and supports for new student accommodation. This is in advance of the delivery of a comprehensive strategy for the rental sector which I will publish before the end of the year.

Total funding for my Department in 2017 is €1.78 billion compared to €1.38 billion this year. This includes €702m in capital funding – an increase of 48% on 2016 and €1,075m in current funding which is an increase of 18% on this year. Overall, the increase of €394m or 28% on 2016.The bulk of the increase is going to housing which is the Government’s number one priority issue. An additional €2m is also being provided in 2017 for the RAPID programme for disadvantaged areas and a new Community Facilities Fund is being included, with an initial €2m being provided in 2017.

The proposed Department Vote 2017 is €1.777 billion (€702m Capital and €1,075m Current) an increase of nearly 30% since 2016 (€1.383 billion).”

Detailed breakdown of each sector

Housing Delivery

- The total exchequer Housing allocation in 2017 will be €1.2 billion. This is broken down into €655m in capital and €566m current funding.

- This compares to €814m in 2016 (€432m Capital, €382m Current). This is an increase in the total Exchequer allocation for housing of €400m, which represents a 50% increase over 2016.

- Local Authorities will also provide funding for Housing in 2017 (LPT self-funding) amounting to €77m Capital and €15m Current. This will bring overall housing allocation to 1.3bn

- Funding under the Housing Programmes will deliver 21,050 units in 2017 through the full range of social housing supports.

- Increased funding for the provision of housing adaptation grants will enable some 9,000 grants to be made in 2017, thereby assisting older people and people with a disability to remain in their own homes and communities.

- Capital of €9m is to be provided in 2017 for Traveller-specific accommodation, an increase of 64%, which will also support the carrying out of fire safety works in traveller accommodation.

- An additional 400 dwellings have been targeted for Pyrite remediation in 2017 through investment of €22 million.

Capital

A total capital provision of €732m (Exchequer provision up 51% on 2016) has been allocated in 2017 and will support the delivery of 4,450 units through the Local Authority and AHB construction and acquisitions programme. This also includes Rapid Builds, units to be delivered through Part V mechanisms, returning vacant units to productive use and delivery of new units under the National Regeneration Programme.

Current

A total provision of €581 million has been allocated in 2017 and will support the delivery of 16,600 units through:

- An allocation of €152.7m (+€105m on 2016) for the Housing Assistance Payment which will enable a further 15,000 households to be accommodated and also support the ongoing costs of 17,000 existing HAP tenancies;

- Funding of €134 million will support a further 1,000 new transfers under the Rental Accommodation Scheme; and

- An increased funding provision of €84 million (+€27m on 2016) under the Social Housing Current Expenditure Programme will support the delivery of 600 direct leased units in 2017. In total, 2,250 units will be delivered in 2017 under the Social Housing Current Expenditure Programme

Homelessness

- A 40% increase in homeless funding from €70m this year to €98m in 2017 will ensure that the increased demand for emergency homeless services is effectively addressed and will assist in supporting homeless households with long term and sustainable housing solutions.

- The increased budget reflects the additional costs of emergency accommodation and homeless services until the housing and homelessness actions & initiatives in Rebuilding Ireland results in hotels only being used as emergency accommodation in limited circumstances by mid-2017.

- In 2017 through a range of funding mechanisms, there will be provision for 3,000 exits from emergency accommodation achieved through mainstream social housing tenancies, rapid build houses and the Housing Assistance Payment.

- The increased budget will assist towards the tripled target of moving 300 people from homelessness into supported tenancies in the Dublin region through the Housing First programme and its extension to other major urban areas.

- These measures will be supported by increased funding in the areas of mental health and addiction from the Department of Health and additional supports for children and families in from the Department of Children & Youth Affairs.

Increasing Supply

First Time Buyers – Help-to-Buy, Mortgage Interest Relief, CAT

- 5% tax rebate for first time buyers of new builds up to €400,000. This is a supply side driver that will be available from 19 July to end 2019

- Maximum rebate of €20,000 applies to properties from €400,000 to €600,000.

- No rebate for properties above €600,000.

- Extension of mortgage interest relief beyond 2017.

- Increased threshold from €280,000 to €310,000 for transfers from parents to children in respect of Capital Acquisitions Tax.

Local Infrastructure Housing Activation Fund

- €200m fund to relieve critical infrastructural blockages and enable the delivery of large scale housing on key development sites.

- This has the potential to open up lands and deliver housing of the order of 15,000 to 20,000 units by 2019.

Planning

- Additional funding is being provided to An Bord Pleanala to support implementation of the new fast-track measures for streamlining the application process for large residential developments, in line with commitments in Rebuilding Ireland.

Bringing vacant properties back into use

Housing Agency Rotating Fund

- The Housing Agency is being provided with €70m capital funding to engage with banks and investment companies to acquire properties for social housing nationally. This will deliver 1,600 units over the period to 2020.

Repair & Leasing Initiative

- New Repair and Leasing Initiative will allow local authorities to provide financial assistance to property owners to bring vacant properties up to standard which can then be leased for social housing. Capital provision of €6 million in 2017 will deliver 150 units under this new initiative.

Buy & Renew Initiative

- A new Buy and Renew initiative will support local authorities and approved housing bodies to purchase private housing units in need of remediation, renew them and make them available for social housing use. An initial capital provision of €25 million will be available for this initiative in 2017.

Living City Initiative

- Changes designed to increase uptake. Maximum floor area restriction is being removed. Requirement for properties to have been used as residential dwelling to avail of support is also being removed, and qualification thresholds are being changed.

Local authority voids

- 800 vacant units will be brought back into use in 2017.

Supporting the Rented Sector

- Mortgage Interest Relief to be fully restored from 75% to 100% over a five year period. Increasing from 75% to 80% in Budget 2017.

- Extension of Living City Initiative to landlords to support investment in rented market.

- Rent a Room ceiling increased from €12,000 to €14,000.

- Strategy for the rental sector will be delivered by end 2016 – work underway at present.

Student Accommodation

- New ISIF support for new investment in student accommodation

- Rent a Room ceiling increased from €12,000 to €14,000

- Higher Education Institutions accessing low cost loan finance from the Housing Finance Agency.

Home Renovation Incentive

- 2 year extension of relief until end 2018 to allow homeowners avail of income tax credit of 13.5% incurred on repair, renovation, or improvement work carried out on residential dwelling.

Community

- €78.2m is provided in 2017 for Community Programmes (€9.6m Capital and €68.6m current) – an increase of 10% on 2016.

- The bulk of the funding relates to Supports for Community and Voluntary Sector (€12.3m) and SICAP (€42.4m).

- Additional funding is being provided in 2017 for the RAPID programme (€2m) and a new Community Facilities Fund (€2m)

Water Services

- €46.5m (Capital €23m and Current €23.5m) is being provided in 2017.

- The bulk of the Capital funding (€17.8m) relates to the Rural Water Programme

- Current funding is provided to support initiatives under the Water Quality Programme. The main focus of this programme is to provide funding for Water Quality, primarily the investment in statutory environmental and public health compliance.

Local Government

- €385m is provided in 2017 under Local Government Programmes (€8.5m Capital and €376.6m Current)

- The Capital expenditure relates to Fire and Emergency Services

- Current Expenditure relates to Franchise (€1.4m), Fire and Emergency Services (€800k) and a payment from the Exchequer to the LGF of €365m

ENDS